This morning’s Wall Street Journal carried a gloomy lead article on the economic outlook: http://online.wsj.com/article/SB119602701188603294.html?mod=hps_us_whats_news. Three recent articles in The Economist : http://www.economist.com/world/na/displaystory.cfm?story_id=10134077

, The New York Times: http://www.businessweek.com/magazine/content/07_48/b4060001.htm

and Businessweek: http://www.nytimes.com/2007/11/25/weekinreview/25goodman.html?_r=1&oref=slogin also provided somber economic forecasts and warnings about consumer spending in particular. They made the case that this time it may indeed be different. Consumers will no longer have the easy access to credit that they had for the past 25 years. Less borrowing means less spending, and that’s bad for the economy. Meanwhile home prices are deflating while gasoline prices are inflating: Two more reasons to anticipate shrinking consumer demand and recession.

But these articles also point out that consumer spending has been counted out before, only to rise again and pull the economy along. The post-2001 expansion is the latest example. The Fed reflated consumer demand by depressing interest rates. Maybe the Fed will again reduce interest rates, and consumer demand and the economy will pop up once more.

Matter of fact, the Federal Reserve does not forecast recession. You can read the Fed’s entire report at: http://www.federalreserve.gov/monetarypolicy/files/fomcminutes20071031.pdf. Here’s a key quote:

“The projections … suggest that … in the near term, output will grow at a pace somewhat below its trend rate and the unemployment rate will edge higher, owing primarily to weakness in housing markets and to the tightening in the availability of credit resulting from recent strains in financial markets. Further ahead, output was projected to expand at a pace close to its long-run trend.”

That’s a forecast for mild slowdown, not recession.

So why is the turning point so hard to call? Why can’t economists agree on a forecast?

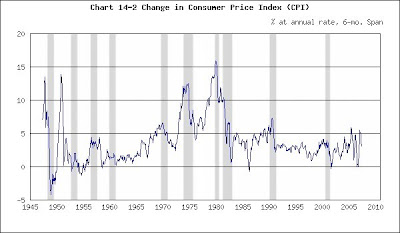

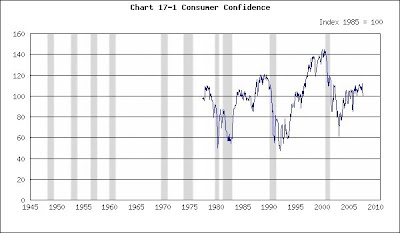

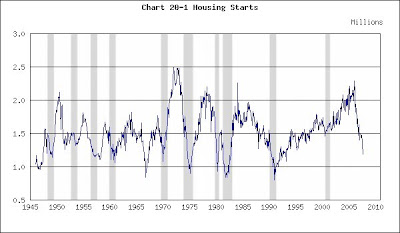

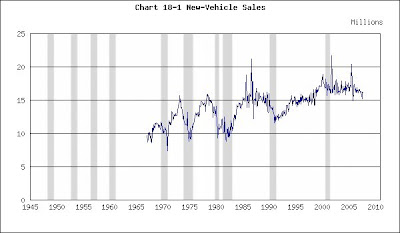

The answer is, “The absence of inflation.” If inflation was surging and consumer confidence slumping, then we could easily forecast recession. For instance, take a look at the direction of consumer prices and consumer confidence in the late 1970s. Prices were heading into the stratosphere, dragging interest rates with them. Consequently consumer confidence plunged into the basement and home construction and auto sales collapsed. That was a classic case of inflation-inspired recession.

Change in Consumer Prices (CPI)

(Click on chart to enlarge)

Recessions shaded

Yield on 10-year Treasury Bond

(Click on chart to enlarge)

Recessions shaded

Consumer Confidence

(Click on chart to enlarge)

Recessions shaded

Housing Starts

(Click on chart to enlarge)

Recessions shaded

New-Vehicle Sales

(Click on chart to enlarge)

Recessions shaded

Now consider the dot.com bust. Inflation was a blip in the late 1990s and consumer confidence at record highs. Interest rates popped up slightly, but housing starts and auto sales remained strong. The consumer had nothing to do with that recession.

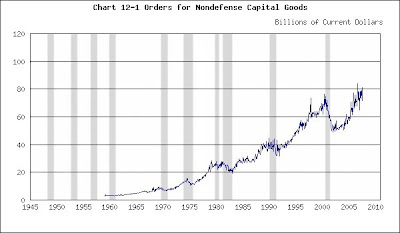

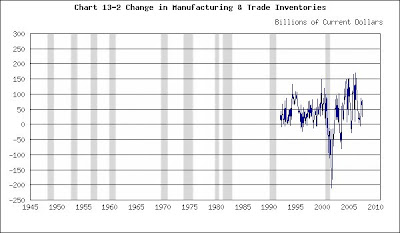

If you examine business investment spending, however, the locus of the 2001 recession comes immediately into focus. Investment in nondefense capital goods (equipment) and business inventories (stocks of goods awaiting sale) plunged. That was a classic business downturn.

New Orders for Nondefense Capital Goods

(Click on chart to enlarge)

Recessions shaded

Inventory Change

(Click on chart to enlarge)

Recessions shaded

So where does that leave us? Let’s recapitulate. Inflation and interest rates are not on a runaway track, and consumer confidence has not (consequently) collapsed. It’s not obvious or inevitable that consumer spending must plunge. Meanwhile business capital expenditures and inventory accumulation remain strong. There’s no sign of slowdown there.

But take a look at the charts leading up to the 1990 recession. Inflation and interest rates were moderate and consumer confidence strong. Auto sales were robust, as were business capital expenditures. Yet falling building activity provided an omen of the slump to come. That sounds a lot like today’s story. Maybe today’s housing slump will also lead to recession.

Now keep the following in mind. The start of the First Persian Gulf War in 1990 had a severe impact on consumer confidence. Without the war there may not have been recession. So the 1990 recession may not be a good example because the war skewed everything.

Now you know why it’s more difficult to forecast the economy than it is to forecast the weather. The economic parameters change over time. The meteorological parameters do not.

Inflation is mild today, as it was in 1990. Does this protect the economy from recession? Will consumer confidence and spending remain high, confining the slump to residential construction? Will the economy soldier through because all problems are encapsulated in housing and there’ll be no metastasis to the rest of the economy? Will the economy’s vaunted flexibility tide us through again? The Fed seems to think so. Others (including this blogger) do not. It’s not easy to forecaste the economy.

(The charts are taken from http://www.beyourowneconomist.com. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of economic indicators.)

No comments:

Post a Comment