It’s 10am Pacific Time (1pm Eastern Time) and the S&P is already up 25 points and the Dow is up over 250, spurred on by interest-rate-cut hopes and falling oil prices: http://money.cnn.com/2007/11/28/markets/markets_1045/index.htm?postversion=2007112810. And that follows yesterday’s big gains. What happened to that stock-market correction and all those fears of recession?

The fears are alive and well, if you look at the rest of the day’s stories.

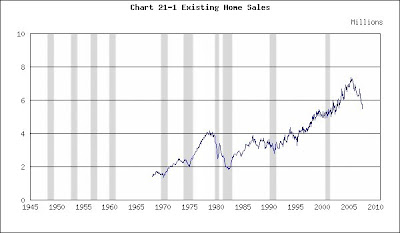

The National Association of Realtors (NAR) reported today that existing-home sales fell to just below 5 million for the first time since the post-9/11 housing boom began: http://www.realtor.org/press_room/news_releases/2007/ehs_oct07_mixed_results.html. (The NAR also reported prices down 5% from a year ago.)

Existing-Home Sales

(Click on chart to enlarge)

Recessions shaded

If you update this chart in your mind’s eye by extending the line below 5 million, you can see home sales are back where they were in the late 1990s and off by about 2 million from their peak. How much further will they fall?

You can see that home sales were cut in half during the back-to-back 1980 and 1981 recessions. Nothing that severe has happened since then. An equivalent drop today would reduce sales to 3.5 million. Scary.

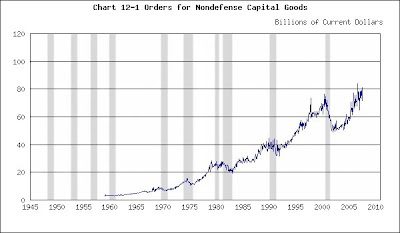

The Census Bureau also reported today on durable-goods orders – new orders for everything from autos to aircraft: http://www.census.gov/indicator/www/m3/adv/pdf/durgd.pdf. They were down as well. A slice of that total, known as new orders for nondefense capital goods, is of interest. This figure represents new business orders for machinery and equipment.

New Orders for Nondefense Capital Goods

(Click on chart to enlarge)

The chart shows that new orders for nondefense capital goods peaked at a little more than 70 million at the height of the dot.com boom before tumbling into the trough of the 2001 recession. Today’s report shows that new orders have been flat at just over 70 million for the past several months. If that signals a new peak, it’s a bad omen. New orders will have barely exceeded their previous high before heading south again. In all previous recoveries from recession, new orders climbed to new heights. If today’s flat spot signals a new peak, the recent expansion will have been weak.

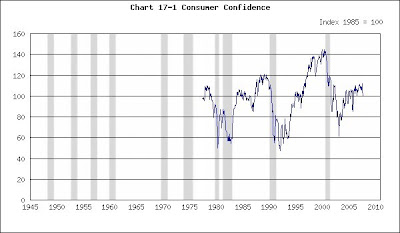

In a final bit of bad news, yesterday the Conference Board reported that its consumer-confidence index had fallen to 87.3: http://www.conference-board.org/economics/ConsumerConfidence.cfm.

Consumer Confidence

(Click on chart to enlarge)

Recessions shaded

It was over 100 not too long ago. Consumers have been bombarded with bad news on housing and fuel prices, and are registering their discomfort. They’re not optimistic about the path ahead.

They’re probably correct.

(The charts are taken from http://www.beyourowneconomist.com. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of economic indicators.)

No comments:

Post a Comment