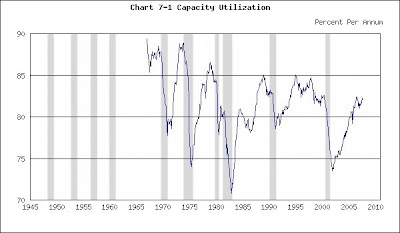

Inflation provided the best indicator of imminent recession in the bad old days of the Old Economy (before the 1990s). Things “heated up” when booming demand boosted output so rapidly that capacity utilization rose above 85%. As productive facilities stretched to the maximum, turning out all the homes, autos (and everything else) they possibly could, productivity (efficiency) fell. Just as your gas mileage plummets and auto-operating costs rise when you press the accelerator to the floor, costs and prices (inflation) rose with a high-speed economy. Rising inflation depressed consumer sentiment and spending, while the Fed drove up interest rates to head off the excess demand that had started the binge. As consumer sentiment headed south and interest rates went north, consumer spending slumped and the economy lapsed into recession.

You can trace this sequence yourself in the charts below. Take a look at the late 1970s and late 1980s. As a robust economy drove up capacity utilization, productivity (efficiency) faltered, sending costs and inflation skyward and depressing consumer confidence. Interest rates rose, too, as the Fed tightened. Demand fell and recession followed.

Capacity Utilization

(Click on chart to enlarge)

Recessions shaded

Consumer Prices

(Click on chart to enlarge)

Consumer Prices

(Click on chart to enlarge)

Recessions shaded

Consumer Confidence

(Click on chart to enlarge)

Consumer Confidence

(Click on chart to enlarge)

Recessions shaded

When the New Economy advocates of the 1990s promised, “This time it’s different. There won’t be a recession,” the dot.com bust proved them wrong. The New Economy did not abolish recession, but the Old Economy rules did fall by the wayside. In the late 1990s consumer confidence climbed to a record high in a climate of moderate capacity utilization and inflation. How had the economy achieved boom without inflation?

Because “this time is different” occurred in a way that few anticipated. This time inflationary pressures channeled into assets (such as the stock market) that are not included in the Consumer Price Index (CPI), instead of channeling into goods and services (such as building materials) that are included in the CPI. The New Economy had added so much hi-tech productive capacity that output surged with less effort than in the past. In addition more demand went overseas into low-cost imports. Consequently inflation and interest rates didn’t escalate and consumer confidence didn’t droop. At the same time, investors diverted their growing incomes into the stock market. When recession struck, it did so for non- traditional reasons: A profit-margin squeeze generated by rising wages (rather than a demand contraction) depressed business confidence and investment.

The Fed employed low interest rates to resuscitate the economy after the 2001 recession. Once again, ample productive capacity restrained capacity utilization and inflation, enabling consumers to channel their rising real incomes into home purchases (which are not in the CPI). That instigated another boom and the real-estate bubble. If recession hits, it won’t be because consumer sentiment faltered due to rising prices and the Fed’s restrictive policies. Recession will occur because another asset bubble deflated, reminiscent of the dot.com bust that came on the heels of the dot.com boom.

When the New Economy advocates of the 1990s promised, “This time it’s different. There won’t be a recession,” the dot.com bust proved them wrong. The New Economy did not abolish recession, but the Old Economy rules did fall by the wayside. In the late 1990s consumer confidence climbed to a record high in a climate of moderate capacity utilization and inflation. How had the economy achieved boom without inflation?

Because “this time is different” occurred in a way that few anticipated. This time inflationary pressures channeled into assets (such as the stock market) that are not included in the Consumer Price Index (CPI), instead of channeling into goods and services (such as building materials) that are included in the CPI. The New Economy had added so much hi-tech productive capacity that output surged with less effort than in the past. In addition more demand went overseas into low-cost imports. Consequently inflation and interest rates didn’t escalate and consumer confidence didn’t droop. At the same time, investors diverted their growing incomes into the stock market. When recession struck, it did so for non- traditional reasons: A profit-margin squeeze generated by rising wages (rather than a demand contraction) depressed business confidence and investment.

The Fed employed low interest rates to resuscitate the economy after the 2001 recession. Once again, ample productive capacity restrained capacity utilization and inflation, enabling consumers to channel their rising real incomes into home purchases (which are not in the CPI). That instigated another boom and the real-estate bubble. If recession hits, it won’t be because consumer sentiment faltered due to rising prices and the Fed’s restrictive policies. Recession will occur because another asset bubble deflated, reminiscent of the dot.com bust that came on the heels of the dot.com boom.

No comments:

Post a Comment