THE BE YOUR OWN ECONOMIST ® BLOG

Here’s January’s economic-indicator publication schedule, followed by a list of web sources. Future postings will discuss these indicators.

You can use the WEB SOURCES listing to find the data on your own and read the accompanying press release. The addresses take you to the source’s home page and the steps tell you how to navigate the site. That way (rather than provide a direct link to the data) you can become familiar with these sites and find additional information on your own.

PUBLICATION SCHEDULE

January 2008

Source (* below)…………Series Description…………Day & Date

Quarterly Data

BEA…………………………GDP………………………...……Wed, 30th

Monthly Data

ISM……………….Purchasing managers’ index….....Wed, 2nd

BLS……………….Employment……………………………Fri, 4th

Fed………………..Consumer credit………………..…….Mon, 7th

Census…………...Balance of trade………………………Fri, 11th

BLS……………….Producer prices……………………….Tue, 15th

Census…………...Retail trade…………………………….Tue, 15th

Census……….....Inventories……………………………..Tue, 15th

BLS……………...Consumer prices……………………...Wed, 16th

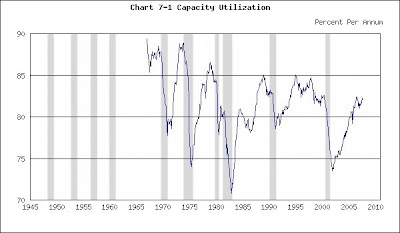

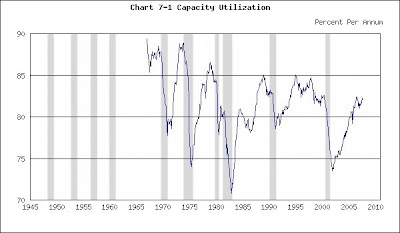

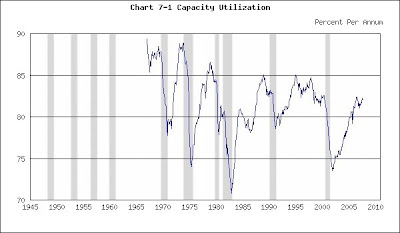

Fed……………….Industrial production……………….Wed, 16th

Fed……………….Capacity utilization……………….….Wed, 16th

Census…………..Housing starts………………………….Thu, 17th

Conf Bd………….Economic Indicators…………..…….Fri , 18th

Census…………..Capital goods……………………….…..Tue, 29th

Conf Bd………….Consumer confidence………………Tue, 29th

Census…………..New-home sales…………………….Mon, 28th

NAR………………Existing-home sales………….…….Thu, 24th

BEA………………Personal income………………………Thu, 31st

* BEA = Bureau of Economic Analysis of the U.S. Department of Commerce

* Census = U.S. Bureau of the Census

* Conf Bd = Conference Board

* Fed = Federal Reserve System

* ISM = Institute for Supply Management

* NAR = National Association of Realtors

WEB SOURCES

Index of Leading Economic Indicators

http://www.conference-board.org/

Step 1: Click on "Economics" in the left-hand menu bar

Step 2: Click on "Economic Indicators" under "Economics" in the left-hand menu bar

Step 3: Click on link under "U.S. Leading Indicators"

Gross Domestic Product

http://www.bea.gov/

Step 1: Click on "Gross Domestic Product" under "National"

Step 2: Click on "National Income and Product Accounts Tables" under "Gross Domestic Product (GDP)"

Step 3: Click on "list of all NIPA Tables"

Step 4: Click on "Table 1.1.6. Real Gross Domestic Product..." and "Table 1.1.1. Percent Change..."

Step 5: Scroll down to line 1 in both tables and go to the last column on the right

Industrial Production & Capacity Utilization

http://www.federalreserve.gov/

Step 1: Click on "All Statistical Releases" under "Recent Statistical Releases" and then click on "Industrial Production and Capacity Utilization" under "Principal Economic Indicators" in the upper left

Step 2: Click on "Current Monthly Release"

Step 3: Find the latest monthly data in the table next to "Total index" and "Total industry"

Institute For Supply Management Index

http://www.ism.ws/

Step 1: Click on "ISM Report on Business" in left-hand menu bar

Step 2: Click on “Latest Manufacturing ROB” and find the latest PMI

Producer Prices

http://stats.bls.gov/

Step 1: Click on “Producer Price Indexes” under “Inflation & Consumer Spending” in left-hand menu bar

Step 2: Note "Finished goods" under "Latest Numbers" in upper right and multiply by 12 to put the data on an annual basis

Business Capital Expenditures (Nondefense Capital Goods)

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "PDF" on the left under "Advance Report on Durable Goods Manufacturers' Shipments and Orders"

Step 3: Scroll down to Table 1 and find new orders for nondefense capital goods near the bottom

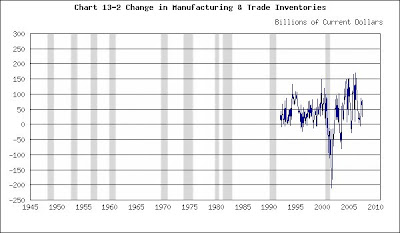

Inventories, Sales & Inventory/Sales Ratio

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "HTML" on the left under "Manufacturing and Trade Inventories and Sales" Step 3: Scroll down to Table 1 and subtract previous month's inventories from latest month's and multiply by 12 to obtain inventory change, and then obtain the most recent inventory/sales ratio

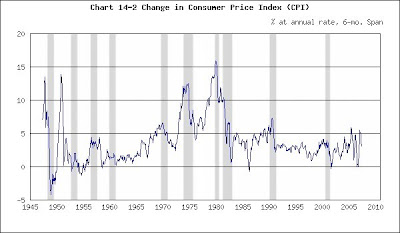

Consumer Price Index

http://stats.bls.gov/

Step 1: Click on “Consumer Price Index” under “Inflation & Consumer Spending” in left-hand menu bar

Step 2: Note "CPI-U..." at the top under "Latest Numbers" in upper right and multiply "SA" by 12 to put the data on an annual basis

Employment Data (Total Non-farm Payroll Employment) (Unemployment Rate) (Manufacturing Workweek)

http://stats.bls.gov/

Step 1: Click on “National Employment” under “Employment & Unemployment” in right-hand menu bar

Step 2: Click on (HTML) following “Employment Situation Summary” under "Economic News Releases"

Step 3: Click on “Employment Situation Summary” under “Table of Contents”

Step 4: Scroll down to Table A and find the unemployment rate for all workers in the latest month, the change in nonfarm employment in the last column and manufacturing hours of work for the latest month

Personal Income

http://www.bea.gov/

Step 1: Click on "Gross Domestic Product" under "National"

Step 2: Click on "National Income and Product Accounts Tables" under "Gross Domestic Product (GDP)"

Step 3: Click on "list of all NIPA Tables"

Step 4: Click on "Table 2.6 Personal Income..."

Step 5: Scroll down to line 1

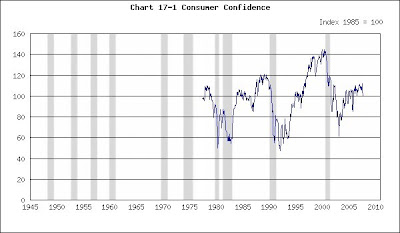

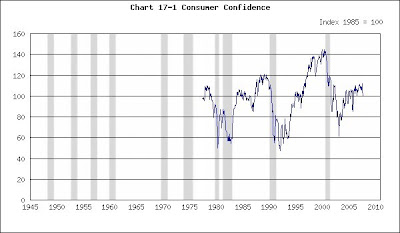

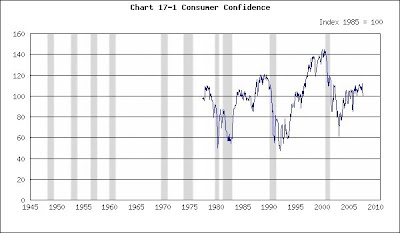

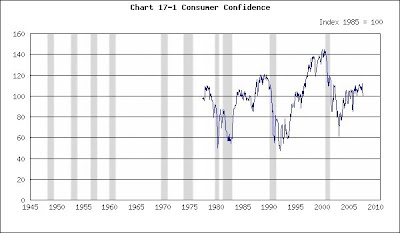

Consumer Confidence

http://www.conference-board.org/

Step 1: Click on the "Economics" in the left-hand menu bar

Step 2: Click on "Economic Indicators" under "Economics" in the left-hand menu bar

Step 3: Click on link under "Consumer Confidence Index"

Consumer Credit

http://www.federalreserve.gov/

Step 1: Click on "All Statistical Releases" under "Recent Statistical Releases" and then click on "Consumer credit -- G19" under "Household Finance" in the upper right

Step 2: Click on "Current Release"

Step 3: Go to "Amount ... billions of dollars" and subtract previous month from current month & multiply by 12 to obtain seasonally adjusted dollar amount at annual rate

Housing Starts

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "PDF" on the left under "Current Press Release" under "Housing Starts/Building Permits"

Step 3: Scroll down to "Housing Starts"

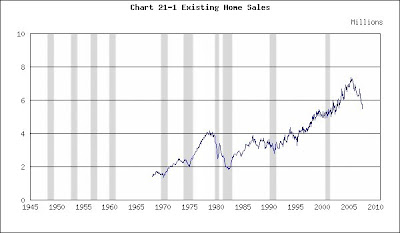

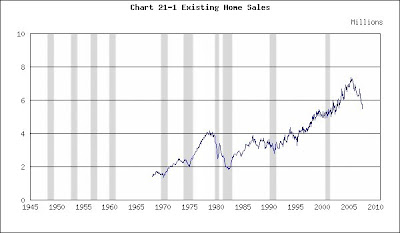

Home Sales (Existing-Home Sales)

http://www.realtor.org/

Step 1: Click on "Research" in the left-hand menu bar

Step 2: Find "Existing-Home Sales" under "Housing Indicators"

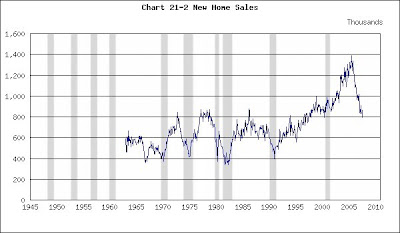

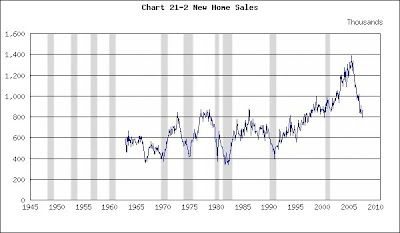

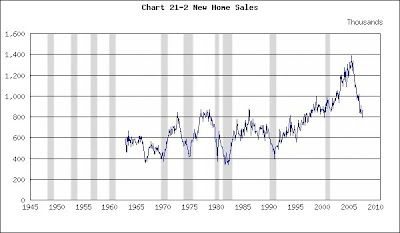

Home Sales (New-Home Sales)

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "PDF" on the left under "Current Press Release" under "New Home Sales"

Retail Sales

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Scroll down to "Advance Monthly Sales for Retail and Food Services" and click on "HTML" on the left under "Current Press Release"

© 2007 Michael B. Lehmann

Monday, December 31, 2007

Saturday, December 22, 2007

This Time It’s Different

THE BE YOUR OWN ECONOMIST ® BLOG

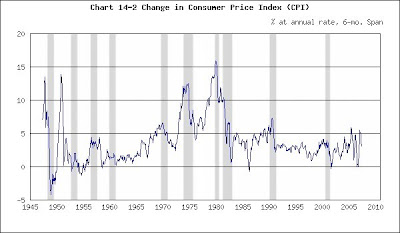

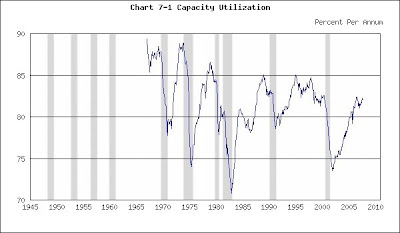

At the height of the late-1990s dot.com boom, New Economy advocates insisted, “This time it’s different,” because (they believed) rising productivity (efficiency) ensured continually rising corporate earnings. Soaring profits guaranteed the stock market would never cease climbing. As long as inflation remained at bay, the engine couldn’t stall. (Because – they thought - only rising inflation brought the higher costs that eroded profit margins.) As we now know, profits stopped rising when full employment boosted wage costs without generating inflation (modest capacity-utilization rates and cheap imports restrained prices). Slumping profits stopped the boom and the bubble burst.

Something similar happened at the height of the recent real-estate boom. Lenders and their advocates (such as the Federal Reserve), insisted this boom was different because of inflation’s absence. Therefore interest rates would not rise and snuff out the mortgage lending that powered the boom. Besides, lenders’ new instruments brought the possibility of homeownership to an ever-wider circle of Americans, constantly expanding the market for new homes. The boom would keep rolling along. The boom’s advocates didn’t realize that a bubble could form without inflation’s presence, and that risky lending practices could imperil financing. Now that the air is escaping from the bubble, it’s not clear that the Fed’s expansionary policy can stop the leak.

Ironically this real-estate boom was different in at least one important way, and that impedes the Fed’s attempts to rescue the economy. See the December 19 article by George Anders in The Wall Street Journal, available at (http://online.wsj.com/article/SB119802116320237959.html).

Mr. Anders observes that shrinking down payments, or their complete absence, have eroded some home owners’ commitment to their homes. In the past substantial down payments buttressed home owners’ commitment to their property. Loan default and abandonment meant forsaking the home owners’ stake in the house. Since buyers had some skin in the game, they were reluctant to walk away from their homes. Today’s buyers are more likely to abandon their properties because they have nothing to lose.

As Mr. Anders put it:

“Because of lax lending standards in the past few years, many homeowners never amassed much equity in their homes. Sizable down payments became a rarity, as many buyers borrowed close to 100% of the purchase price through a blend of first mortgages and home-equity lines of credit. Others kept refinancing their mortgages as property prices climbed, taking on bigger loans and draining the equity value of their homes.

“As a result, there is a new class of homeowners in name only. Because these people never put up much of their own money, they don't act like owners, committed to their property for the long haul. They behave more like renters, ducking out of an onerous lease in the midst of a housing slump.

“In such an environment credit scores don't really provide a definitive gauge of how hard a borrower will work to avoid default, says Mark Zandi, chief economist of Moody's Economy.com Inc., a West Chester, Pa., economic-research firm. A better test, he says, is how much equity owners have in their home. If they have a lot at stake, default becomes almost unthinkable. Without much equity, the commitment to keep paying the mortgage, no matter painful that may be, begins to dwindle.

“How did banks' lending standards get so far off course? Familiar answers include a race for market share, a herd mentality and the apparent profitability of risky lending in boom times.”

If the real-estate bust does drag the economy down into a slump, there’s another way this time may be different. The Fed’s expansionary policies easily cured past recessions that had been instigated by rising prices and interest rates. As soon as recession halted the inflation, and the Fed’s expansionary policies depressed interest rates, borrowing and spending snapped back. The economy was off and running again. Low interest rates cured the 2001 recession by substituting a real-estate bubble for the dot.com bubble.

This time, however, falling interest rates may not work effectively to re-start demand. The residential real-estate market may be too depressed for lower interest rates to work their magic. Why buy an asset with little prospect for appreciation?

That could present a different kind of problem for the American economy. It may begin to resemble Japan’s economy in the 1990s. Japan took more than a decade to recover from its real-estate bust and its economy consequently languished.

As the December 15 Economist (http://www.economist.com/research/articlesbysubject/displaystory.cfm?subjectid=2764524&story_id=10286992) said:

“Another month, another bank in trouble, another raised estimate of bad assets in the financial system, and another move by the central bank to try and contain the problem: to observers in Japan, America's spreading credit crunch has an eerily familiar ring.

“Though differences between the subprime crisis and the bursting of Japan's own property bubble after 1989 are inevitably great, the similarities are striking.”

This time may really be different if the Fed’s expansionary policy can’t work its magic once more.

© 2007 Michael B. Lehmann

At the height of the late-1990s dot.com boom, New Economy advocates insisted, “This time it’s different,” because (they believed) rising productivity (efficiency) ensured continually rising corporate earnings. Soaring profits guaranteed the stock market would never cease climbing. As long as inflation remained at bay, the engine couldn’t stall. (Because – they thought - only rising inflation brought the higher costs that eroded profit margins.) As we now know, profits stopped rising when full employment boosted wage costs without generating inflation (modest capacity-utilization rates and cheap imports restrained prices). Slumping profits stopped the boom and the bubble burst.

Something similar happened at the height of the recent real-estate boom. Lenders and their advocates (such as the Federal Reserve), insisted this boom was different because of inflation’s absence. Therefore interest rates would not rise and snuff out the mortgage lending that powered the boom. Besides, lenders’ new instruments brought the possibility of homeownership to an ever-wider circle of Americans, constantly expanding the market for new homes. The boom would keep rolling along. The boom’s advocates didn’t realize that a bubble could form without inflation’s presence, and that risky lending practices could imperil financing. Now that the air is escaping from the bubble, it’s not clear that the Fed’s expansionary policy can stop the leak.

Ironically this real-estate boom was different in at least one important way, and that impedes the Fed’s attempts to rescue the economy. See the December 19 article by George Anders in The Wall Street Journal, available at (http://online.wsj.com/article/SB119802116320237959.html).

Mr. Anders observes that shrinking down payments, or their complete absence, have eroded some home owners’ commitment to their homes. In the past substantial down payments buttressed home owners’ commitment to their property. Loan default and abandonment meant forsaking the home owners’ stake in the house. Since buyers had some skin in the game, they were reluctant to walk away from their homes. Today’s buyers are more likely to abandon their properties because they have nothing to lose.

As Mr. Anders put it:

“Because of lax lending standards in the past few years, many homeowners never amassed much equity in their homes. Sizable down payments became a rarity, as many buyers borrowed close to 100% of the purchase price through a blend of first mortgages and home-equity lines of credit. Others kept refinancing their mortgages as property prices climbed, taking on bigger loans and draining the equity value of their homes.

“As a result, there is a new class of homeowners in name only. Because these people never put up much of their own money, they don't act like owners, committed to their property for the long haul. They behave more like renters, ducking out of an onerous lease in the midst of a housing slump.

“In such an environment credit scores don't really provide a definitive gauge of how hard a borrower will work to avoid default, says Mark Zandi, chief economist of Moody's Economy.com Inc., a West Chester, Pa., economic-research firm. A better test, he says, is how much equity owners have in their home. If they have a lot at stake, default becomes almost unthinkable. Without much equity, the commitment to keep paying the mortgage, no matter painful that may be, begins to dwindle.

“How did banks' lending standards get so far off course? Familiar answers include a race for market share, a herd mentality and the apparent profitability of risky lending in boom times.”

If the real-estate bust does drag the economy down into a slump, there’s another way this time may be different. The Fed’s expansionary policies easily cured past recessions that had been instigated by rising prices and interest rates. As soon as recession halted the inflation, and the Fed’s expansionary policies depressed interest rates, borrowing and spending snapped back. The economy was off and running again. Low interest rates cured the 2001 recession by substituting a real-estate bubble for the dot.com bubble.

This time, however, falling interest rates may not work effectively to re-start demand. The residential real-estate market may be too depressed for lower interest rates to work their magic. Why buy an asset with little prospect for appreciation?

That could present a different kind of problem for the American economy. It may begin to resemble Japan’s economy in the 1990s. Japan took more than a decade to recover from its real-estate bust and its economy consequently languished.

As the December 15 Economist (http://www.economist.com/research/articlesbysubject/displaystory.cfm?subjectid=2764524&story_id=10286992) said:

“Another month, another bank in trouble, another raised estimate of bad assets in the financial system, and another move by the central bank to try and contain the problem: to observers in Japan, America's spreading credit crunch has an eerily familiar ring.

“Though differences between the subprime crisis and the bursting of Japan's own property bubble after 1989 are inevitably great, the similarities are striking.”

This time may really be different if the Fed’s expansionary policy can’t work its magic once more.

© 2007 Michael B. Lehmann

Friday, December 14, 2007

Happy Holidays!

THE BE YOUR OWN ECONOMIST ® BLOG

The blogger will hit the road for three weeks to visit family and friends and will reduce his postings while on the way.

Regular postings will resume on January 7, 2008.

Happy Holidays!

© 2007 Michael B. Lehmann

The blogger will hit the road for three weeks to visit family and friends and will reduce his postings while on the way.

Regular postings will resume on January 7, 2008.

Happy Holidays!

© 2007 Michael B. Lehmann

Wednesday, December 12, 2007

Two Bits of Bad News

THE BE YOUR OWN ECONOMIST ® BLOG

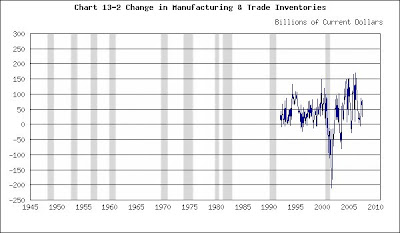

While this blog remained preoccupied with the December 7 employment report and the December 11 Federal Reserve rate cut, two other statistics were released to little notice. They should have received more attention because they could be bad omens for consumer demand and corporate profits.

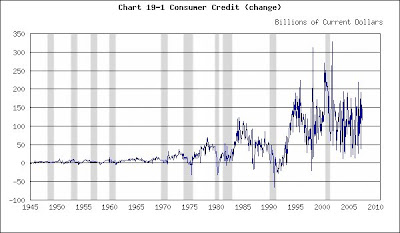

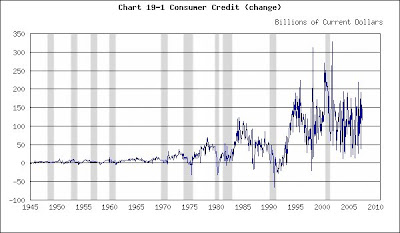

On December 7 the Fed reported (http://www.federalreserve.gov/releases/g19/Current/) that consumer credit grew $4.7 billion in October. (You can obtain this figure from the press release by subtracting September’s outstanding debt - seasonally adjusted – from October’s.) Multiply that number by 12 to put the data on an annual basis. Now compare that $56.4 billion product in your mind’s eye with the series in the chart below.

Consumer Credit

(Click on chart to enlarge)

Recessions shaded

Consumer credit is the kind of borrowing we resort to when we “buy on time.” It typically finances consumer-durables expenditures such as automobile purchases. It does not include real-estate mortgage debt, financing or refinancing of any kind.

There’s plenty of noise in the data. The line wobbles like the Richter Scale during a California earthquake. Yet your mind’s eye can see that consumer credit has been growing by $100 billion per month at an annual rate for the past half decade. October’s $56.4 billion is a downward break from that trend, and September’s $38.4 billion was even more anemic. Does the apparent shrinkage signal consumers’ future reluctance to buy? Stay tuned.

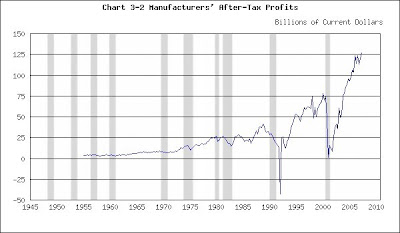

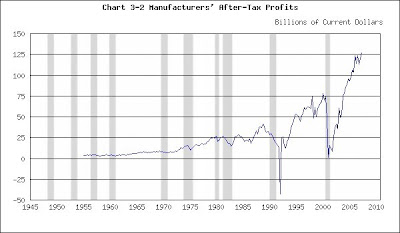

On December 10 the Census Bureau reported (http://www.census.gov/csd/qfr/view/qfr_mg.pdf) that manufacturers’ after-tax profits fell to $87.563 billion in the third quarter. Update the chart below in your mind’s eye and you can see the substantial drop in earnings. Profits had been in the $120 billion range through the second quarter. Unlike the consumer credit statistic, this series does not have a lot of noise. A $35 billion plunge is probably a noteworthy event, not a random hiccup in the data.

Manufacturing After-Tax profits

(Click on chart to enlarge)

Recessions shaded

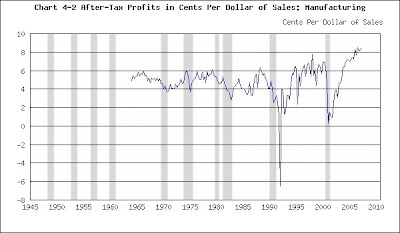

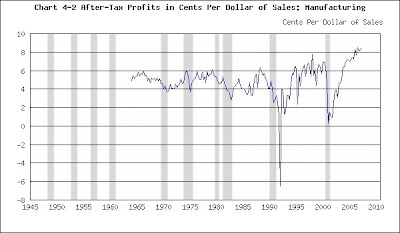

At the same time the Census Bureau also reported that manufacturing profit margins fell to 5.67 cents per dollar of sales from over 8 cents in the second quarter. This decline in margins probably generated the overall drop in profits noted above. Strong competitive pressures may have prevented management from raising prices sufficiently to recoup increased costs.

Update the chart below in your mind’s eye. This chart does not have a lot of noise either. A 2-cent decline in margins is a noteworthy event.

Manufacturing Profit Margins in Cents Per Dollar of Sales

(Click on chart to enlarge)

Recessions shaded

Declining profits and profitability (margins) are bad omens for the economy. Together with the deterioration in consumer credit………… Let’s just say they’re cause for concern.

(The charts were taken from http://www.beyourowneconomist.com. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of Economic Indicators.)

© 2007 Michael B. Lehmann

While this blog remained preoccupied with the December 7 employment report and the December 11 Federal Reserve rate cut, two other statistics were released to little notice. They should have received more attention because they could be bad omens for consumer demand and corporate profits.

On December 7 the Fed reported (http://www.federalreserve.gov/releases/g19/Current/) that consumer credit grew $4.7 billion in October. (You can obtain this figure from the press release by subtracting September’s outstanding debt - seasonally adjusted – from October’s.) Multiply that number by 12 to put the data on an annual basis. Now compare that $56.4 billion product in your mind’s eye with the series in the chart below.

Consumer Credit

(Click on chart to enlarge)

Recessions shaded

Consumer credit is the kind of borrowing we resort to when we “buy on time.” It typically finances consumer-durables expenditures such as automobile purchases. It does not include real-estate mortgage debt, financing or refinancing of any kind.

There’s plenty of noise in the data. The line wobbles like the Richter Scale during a California earthquake. Yet your mind’s eye can see that consumer credit has been growing by $100 billion per month at an annual rate for the past half decade. October’s $56.4 billion is a downward break from that trend, and September’s $38.4 billion was even more anemic. Does the apparent shrinkage signal consumers’ future reluctance to buy? Stay tuned.

On December 10 the Census Bureau reported (http://www.census.gov/csd/qfr/view/qfr_mg.pdf) that manufacturers’ after-tax profits fell to $87.563 billion in the third quarter. Update the chart below in your mind’s eye and you can see the substantial drop in earnings. Profits had been in the $120 billion range through the second quarter. Unlike the consumer credit statistic, this series does not have a lot of noise. A $35 billion plunge is probably a noteworthy event, not a random hiccup in the data.

Manufacturing After-Tax profits

(Click on chart to enlarge)

Recessions shaded

At the same time the Census Bureau also reported that manufacturing profit margins fell to 5.67 cents per dollar of sales from over 8 cents in the second quarter. This decline in margins probably generated the overall drop in profits noted above. Strong competitive pressures may have prevented management from raising prices sufficiently to recoup increased costs.

Update the chart below in your mind’s eye. This chart does not have a lot of noise either. A 2-cent decline in margins is a noteworthy event.

Manufacturing Profit Margins in Cents Per Dollar of Sales

(Click on chart to enlarge)

Recessions shaded

Declining profits and profitability (margins) are bad omens for the economy. Together with the deterioration in consumer credit………… Let’s just say they’re cause for concern.

(The charts were taken from http://www.beyourowneconomist.com. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of Economic Indicators.)

© 2007 Michael B. Lehmann

Tuesday, December 11, 2007

A Quarter of a Point

THE BE YOUR OWN ECONOMIST ® BLOG

The Federal Reserve reduced the federal-funds rate by a quarter-of-a-point today. You can find the Fed’s announcement at http://www.federalreserve.gov/newsevents/press/monetary/20071211a.htm.

The text follows:

“The Federal Open Market Committee decided today to lower its target for the federal funds rate 25 basis points to 4-1/4 percent.

“Incoming information suggests that economic growth is slowing, reflecting the intensification of the housing correction and some softening in business and consumer spending. Moreover, strains in financial markets have increased in recent weeks. Today’s action, combined with the policy actions taken earlier, should help promote moderate growth over time.

“Readings on core inflation have improved modestly this year, but elevated energy and commodity prices, among other factors, may put upward pressure on inflation. In this context, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

“Recent developments, including the deterioration in financial market conditions, have increased the uncertainty surrounding the outlook for economic growth and inflation. The Committee will continue to assess the effects of financial and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

“Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Charles L. Evans; Thomas M. Hoenig; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; William Poole; and Kevin M. Warsh. Voting against was Eric S. Rosengren, who preferred to lower the target for the federal funds rate by 50 basis points at this meeting.

“In a related action, the Board of Governors unanimously approved a 25-basis-point decrease in the discount rate to 4-3/4 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, and St. Louis.”

The news disappointed the stock market. The S&P fell 38 points and the Dow was down 294 at the close. That’s not surprising. The stock market likes falling interest rates, and most investors obviously preferred a deeper cut. Falling interest rates – on investments that are an alternative to stocks - improve stocks’ attractiveness. Other stock sellers may believe that the Fed’s actions reveal the Fed’s failure to appreciate the likelihood of recession. Those sellers bailed out because they fear the Fed will fail to take sufficient corrective action – in the form of interest-rate reductions – to prevent recession.

But that begs the question of whether or not falling interest rates can prevent recession. Here are the issues.

Economists traditionally prescribed an expansionary monetary policy to counteract economic sluggishness. All things being equal, as the economists like to say, business firms invest more in plant, equipment and inventory when interest rates fall. Lower rates facilitate the borrowing that finances capital expenditures, and lower rates encourage business to invest its own funds in capital expansion rather than purchase an interest-earning instrument.

That logic extended to household capital expenditures because lower mortgage rates encouraged residential construction, and rising rates discouraged building. That was especially evident in the 1960s, 1970s and 1980s. Rapid economic expansion in those decades periodically generated inflation and (with the Fed’s encouragement) rising interest rates. Residential construction slumped when rates rose, and did not bounce back until falling inflation and (with the Fed’s connivance) falling interest rates encouraged construction’s recovery. To sum up: Rates down = construction up = economic recovery.

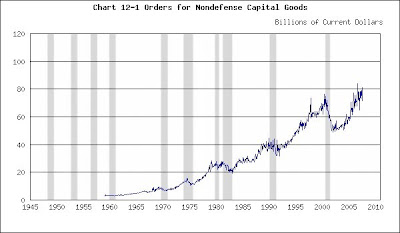

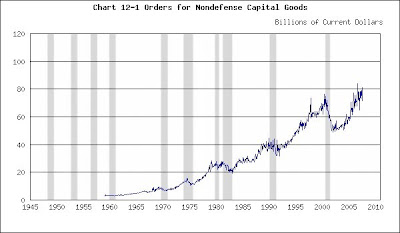

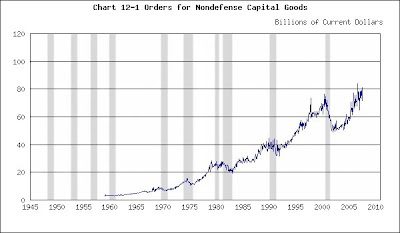

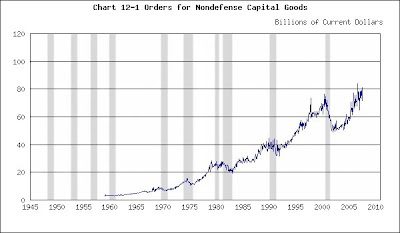

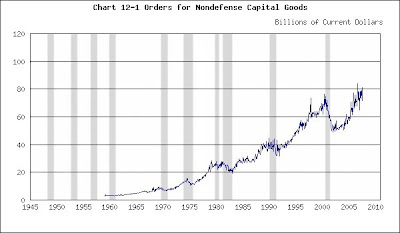

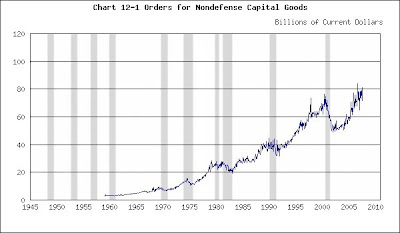

The 2001 recession provides an interesting illustration. Business capital expenditures slumped dramatically, as the chart below illustrates.

Nondefense Capital Goods

(Click on chart to enlarge)

Recessions shaded

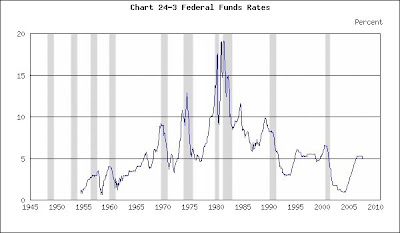

Nondefense capital expenditures (everything from Boeings to backhoes) tumbled because of the 2001 dot.com bust. The Fed rode to the rescue, as the next chart shows.

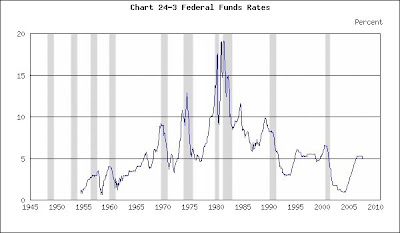

Federal Funds Rate

(Click on chart to enlarge)

Recessions shaded

The Fed sharply reduced the federal-funds rate in 2001, and you can see that nondefense capital goods began to recover. But the rate cut probably had little to do with that capital-expenditure rebound. Technology had its own imperatives that loomed larger than prevailing interest rates.

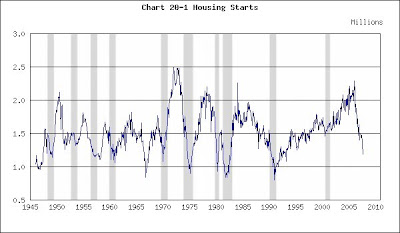

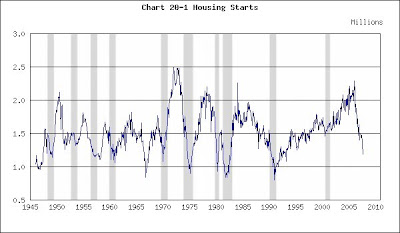

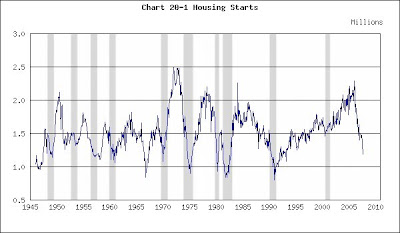

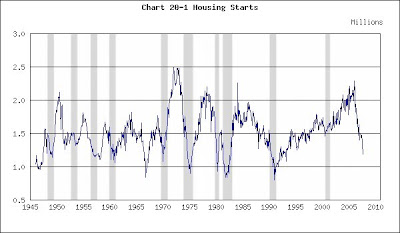

Housing Starts

(Click on chart to enlarge)

Recessions shaded

Housing starts are another matter. No one doubts that falling mortgage rates kindled the 2001 – 2005 construction boom. It was a traditional example of the salutary effect of a Fed rate cut upon housing activity. To sum up (once again): Rates down = construction up = economic recovery.

But something unusual happened next. The economy soared, yet there was no inflation. Instead a speculative bubble emerged in the housing market. Then the air began to leak from the bubble and the great housing implosion began. It was an old-fashioned sell-off, akin to the 2000 – 2002 stock-market panic. Real-estate prices fell in an atmosphere of low inflation. The decline bore little similarity to the (inflation-driven, rising interest rate) housing slumps of old.

So the question arises, “If this housing bust is unlike the housing downturns of the past, can the Fed’s traditional rate-cut policy spur recovery?”

We’ll wait and see, but the probable answer is: “Not likely. If rising inflation and rising interest rates didn’t cause the slump, how effectively can falling rates generate recovery?”

(The charts were taken from http://www.beyourowneconomist.com. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of Economic Indicators.)

© 2007 Michael B. Lehmann

The Federal Reserve reduced the federal-funds rate by a quarter-of-a-point today. You can find the Fed’s announcement at http://www.federalreserve.gov/newsevents/press/monetary/20071211a.htm.

The text follows:

“The Federal Open Market Committee decided today to lower its target for the federal funds rate 25 basis points to 4-1/4 percent.

“Incoming information suggests that economic growth is slowing, reflecting the intensification of the housing correction and some softening in business and consumer spending. Moreover, strains in financial markets have increased in recent weeks. Today’s action, combined with the policy actions taken earlier, should help promote moderate growth over time.

“Readings on core inflation have improved modestly this year, but elevated energy and commodity prices, among other factors, may put upward pressure on inflation. In this context, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

“Recent developments, including the deterioration in financial market conditions, have increased the uncertainty surrounding the outlook for economic growth and inflation. The Committee will continue to assess the effects of financial and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

“Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Charles L. Evans; Thomas M. Hoenig; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; William Poole; and Kevin M. Warsh. Voting against was Eric S. Rosengren, who preferred to lower the target for the federal funds rate by 50 basis points at this meeting.

“In a related action, the Board of Governors unanimously approved a 25-basis-point decrease in the discount rate to 4-3/4 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, and St. Louis.”

The news disappointed the stock market. The S&P fell 38 points and the Dow was down 294 at the close. That’s not surprising. The stock market likes falling interest rates, and most investors obviously preferred a deeper cut. Falling interest rates – on investments that are an alternative to stocks - improve stocks’ attractiveness. Other stock sellers may believe that the Fed’s actions reveal the Fed’s failure to appreciate the likelihood of recession. Those sellers bailed out because they fear the Fed will fail to take sufficient corrective action – in the form of interest-rate reductions – to prevent recession.

But that begs the question of whether or not falling interest rates can prevent recession. Here are the issues.

Economists traditionally prescribed an expansionary monetary policy to counteract economic sluggishness. All things being equal, as the economists like to say, business firms invest more in plant, equipment and inventory when interest rates fall. Lower rates facilitate the borrowing that finances capital expenditures, and lower rates encourage business to invest its own funds in capital expansion rather than purchase an interest-earning instrument.

That logic extended to household capital expenditures because lower mortgage rates encouraged residential construction, and rising rates discouraged building. That was especially evident in the 1960s, 1970s and 1980s. Rapid economic expansion in those decades periodically generated inflation and (with the Fed’s encouragement) rising interest rates. Residential construction slumped when rates rose, and did not bounce back until falling inflation and (with the Fed’s connivance) falling interest rates encouraged construction’s recovery. To sum up: Rates down = construction up = economic recovery.

The 2001 recession provides an interesting illustration. Business capital expenditures slumped dramatically, as the chart below illustrates.

Nondefense Capital Goods

(Click on chart to enlarge)

Recessions shaded

Nondefense capital expenditures (everything from Boeings to backhoes) tumbled because of the 2001 dot.com bust. The Fed rode to the rescue, as the next chart shows.

Federal Funds Rate

(Click on chart to enlarge)

Recessions shaded

The Fed sharply reduced the federal-funds rate in 2001, and you can see that nondefense capital goods began to recover. But the rate cut probably had little to do with that capital-expenditure rebound. Technology had its own imperatives that loomed larger than prevailing interest rates.

Housing Starts

(Click on chart to enlarge)

Recessions shaded

Housing starts are another matter. No one doubts that falling mortgage rates kindled the 2001 – 2005 construction boom. It was a traditional example of the salutary effect of a Fed rate cut upon housing activity. To sum up (once again): Rates down = construction up = economic recovery.

But something unusual happened next. The economy soared, yet there was no inflation. Instead a speculative bubble emerged in the housing market. Then the air began to leak from the bubble and the great housing implosion began. It was an old-fashioned sell-off, akin to the 2000 – 2002 stock-market panic. Real-estate prices fell in an atmosphere of low inflation. The decline bore little similarity to the (inflation-driven, rising interest rate) housing slumps of old.

So the question arises, “If this housing bust is unlike the housing downturns of the past, can the Fed’s traditional rate-cut policy spur recovery?”

We’ll wait and see, but the probable answer is: “Not likely. If rising inflation and rising interest rates didn’t cause the slump, how effectively can falling rates generate recovery?”

(The charts were taken from http://www.beyourowneconomist.com. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of Economic Indicators.)

© 2007 Michael B. Lehmann

Friday, December 7, 2007

94,000……

THE LEHMANN LETTER

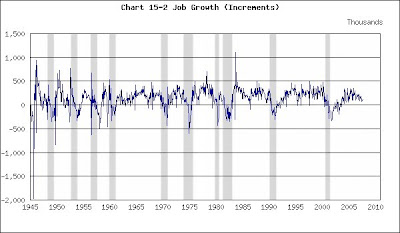

This morning the Bureau of Labor Statistics (BLS) reported (http://stats.bls.gov/news.release/empsit.nr0.htm ) that nonfarm payroll employment grew by 94,000 in November.

Here’s the first paragraph of that report:

“Nonfarm payroll employment continued to trend up in November (94,000), andthe unemployment rate held at 4.7 percent, the Bureau of Labor Statistics of theU.S. Department of Labor reported today. Job growth continued in professionaland technical services, health care, and food services. Employment continued todecline in manufacturing and also fell in several housing-related industries,including construction, credit intermediation, and real estate. Average hourlyearnings rose by 8 cents over the month.”

Use the 94,000 job-growth figure to update the chart below in your mind’s eye.

Job Growth

(Click on chart to enlarge)

This morning the Bureau of Labor Statistics (BLS) reported (http://stats.bls.gov/news.release/empsit.nr0.htm ) that nonfarm payroll employment grew by 94,000 in November.

Here’s the first paragraph of that report:

“Nonfarm payroll employment continued to trend up in November (94,000), andthe unemployment rate held at 4.7 percent, the Bureau of Labor Statistics of theU.S. Department of Labor reported today. Job growth continued in professionaland technical services, health care, and food services. Employment continued todecline in manufacturing and also fell in several housing-related industries,including construction, credit intermediation, and real estate. Average hourlyearnings rose by 8 cents over the month.”

Use the 94,000 job-growth figure to update the chart below in your mind’s eye.

Job Growth

(Click on chart to enlarge)

Recessions shaded

That’s not a bad number, but you can see the falling trend. The economy is not creating the 150,000 to 200,000 jobs a month as it was a year or two ago, and is nowhere near the 200,000 to 300,000 pace of the late 1990s. The quote above identifies manufacturing, home-construction, mortgage-financing and real estate as areas of job loss.

None of this is surprising. The economy is weakening and everyone is waiting to see whether the slump in housing, and all its attendant sectors and industries, will pull the rest of the economy down with it. Or, perhaps, the economy will perk up and cruise along. So far there is no clear trend in either direction, and this morning's job-growth report does not settle the issue.

(The chart was taken from http://www.beyourowneconomist.com/. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of Economic Indicators.)

The Lehmann Letter © 2007 Michael B. Lehmann

That’s not a bad number, but you can see the falling trend. The economy is not creating the 150,000 to 200,000 jobs a month as it was a year or two ago, and is nowhere near the 200,000 to 300,000 pace of the late 1990s. The quote above identifies manufacturing, home-construction, mortgage-financing and real estate as areas of job loss.

None of this is surprising. The economy is weakening and everyone is waiting to see whether the slump in housing, and all its attendant sectors and industries, will pull the rest of the economy down with it. Or, perhaps, the economy will perk up and cruise along. So far there is no clear trend in either direction, and this morning's job-growth report does not settle the issue.

(The chart was taken from http://www.beyourowneconomist.com/. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of Economic Indicators.)

The Lehmann Letter © 2007 Michael B. Lehmann

Thursday, December 6, 2007

Sub-Prime Plan

The Lehmann Letter ©

Sub-Prime Plan

This morning’s New York Times ran a story (http://www.nytimes.com/2007/12/06/washington/06debt.html?_r=1&oref=slogin)

on the Bush administration’s sub-prime-mortgage bailout plan. It contained an observation and a quote that do not inspire confidence.

Any plan must spare borrowers with adjustable-rate mortgages from an imminent reset to a rate higher than the borrowers can afford. The reset is postponed to the day when the borrowers are better able to meet their obligations or home prices rise once again to the point that refinancing become possible. If millions of borrowers are potentially eligible, however, there will be efforts to exclude those who can pay under any circumstances – and therefore don’t need assistance - and those who are unable to pay under any circumstances –and therefore should be excluded from eligibility.

Here is the excerpt from The New York Times article.

“Barclays Capital — extrapolating from a similar program recently unveiled in California — estimates that only about 12 percent of all subprime borrowers, or 240,000 homeowners, would get relief.

“From what I’ve heard, I don’t see anything that leads me to believe we will see an increase in loan modifications,” said Eric Halperin, Washington director of the Center for Responsible Lending, a nonprofit group that has studied the subprime problem.”

Moreover, some have asked the obvious question, “Suppose the housing-price decline lasts longer than anticipated or there’s a recession or there’s a steep increase in interest rates, how will the beneficiaries of the plan deal with a reset any time soon?” Others who are meeting their reset obligations question the fairness of helping those who don’t or won’t meet theirs. And so on.

But there’s a larger issue. Our economic system requires profitability and continually expanding demand. Profits are an incentive to produce and continually expanding demand assures profitability. Accordingly mortgage lenders strive to broaden the scope of their operations. When interest rates reach an irreducible minimum, new methods must be found to expand the pool of potential borrowers. That leads to no money down, no income qualification to borrow and a low (adjustable) teaser rate to draw the borrower into the deal.

The entire economy benefitted from these innovations after the 2001 recession as booming real-estate and home-construction markets pulled the economy out of the trough. The Fed did not object because international competition and plenty of excess capacity held prices down. We had asset inflation rather than price inflation, and asset inflation is not in the Fed’s play book. Then the bubble burst and the flaws became apparent.

Debt is not the lubricant that greases the gears, it’s the fuel that powers the engine. We’ve come to rely on this gas guzzler. There’s no other model in reserve.

Sub-Prime Plan

This morning’s New York Times ran a story (http://www.nytimes.com/2007/12/06/washington/06debt.html?_r=1&oref=slogin)

on the Bush administration’s sub-prime-mortgage bailout plan. It contained an observation and a quote that do not inspire confidence.

Any plan must spare borrowers with adjustable-rate mortgages from an imminent reset to a rate higher than the borrowers can afford. The reset is postponed to the day when the borrowers are better able to meet their obligations or home prices rise once again to the point that refinancing become possible. If millions of borrowers are potentially eligible, however, there will be efforts to exclude those who can pay under any circumstances – and therefore don’t need assistance - and those who are unable to pay under any circumstances –and therefore should be excluded from eligibility.

Here is the excerpt from The New York Times article.

“Barclays Capital — extrapolating from a similar program recently unveiled in California — estimates that only about 12 percent of all subprime borrowers, or 240,000 homeowners, would get relief.

“From what I’ve heard, I don’t see anything that leads me to believe we will see an increase in loan modifications,” said Eric Halperin, Washington director of the Center for Responsible Lending, a nonprofit group that has studied the subprime problem.”

Moreover, some have asked the obvious question, “Suppose the housing-price decline lasts longer than anticipated or there’s a recession or there’s a steep increase in interest rates, how will the beneficiaries of the plan deal with a reset any time soon?” Others who are meeting their reset obligations question the fairness of helping those who don’t or won’t meet theirs. And so on.

But there’s a larger issue. Our economic system requires profitability and continually expanding demand. Profits are an incentive to produce and continually expanding demand assures profitability. Accordingly mortgage lenders strive to broaden the scope of their operations. When interest rates reach an irreducible minimum, new methods must be found to expand the pool of potential borrowers. That leads to no money down, no income qualification to borrow and a low (adjustable) teaser rate to draw the borrower into the deal.

The entire economy benefitted from these innovations after the 2001 recession as booming real-estate and home-construction markets pulled the economy out of the trough. The Fed did not object because international competition and plenty of excess capacity held prices down. We had asset inflation rather than price inflation, and asset inflation is not in the Fed’s play book. Then the bubble burst and the flaws became apparent.

Debt is not the lubricant that greases the gears, it’s the fuel that powers the engine. We’ve come to rely on this gas guzzler. There’s no other model in reserve.

Wednesday, December 5, 2007

Productivity

The Lehmann Letter ©

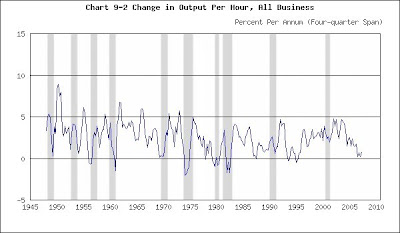

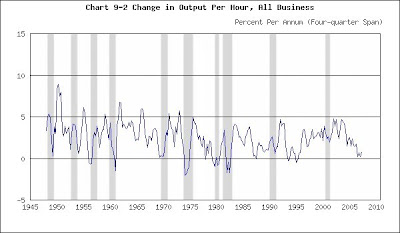

Stocks jumped this morning when the Bureau of Labor Statistics (BLS) announced (http://stats.bls.gov/news.release/prod2.nr0.htm) that third-quarter productivity had surged 6.7%. Use that number to update the chart below in your mind’s eye, and you’ll appreciate the impressive size of this gain. There hasn’t been a jump like that in years.

Productivity

(Click on chart to enlarge)

Recessions shaded

Productivity measures the economy’s efficiency: How much output grows for each additional hour of labor employed. (Think of miles per gallon [MPG] as an analogy. An efficient engine travels further - and less expensively - on a gallon of fuel.) Greater output per hour of work indicates that fewer hours were required to complete a task. Since labor must be paid, rising productivity – and falling labor time per unit of output – implies falling costs. And sure enough, the BLS also reported unit labor costs fell 2.0% in the third quarter.

Investors love reports like these because rising productivity and falling costs signal a reduction in inflationary pressures. That means the Fed is more likely to reduce interest rates at its December 11 meeting. Falling interest rates are good for stocks because stock prices rise when investors desert interest-earning assets (with declining yields) in order to purchase stocks.

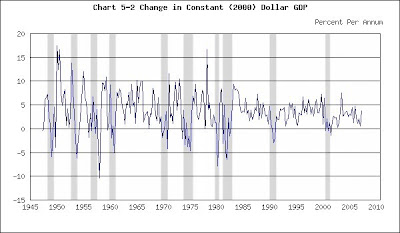

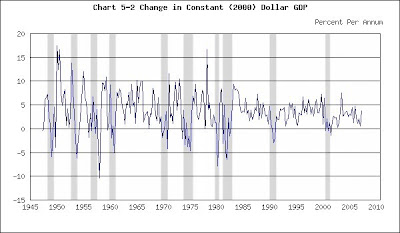

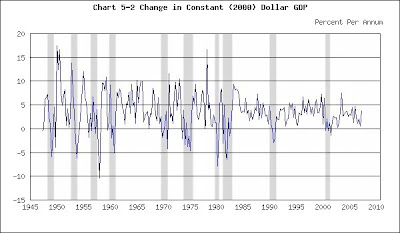

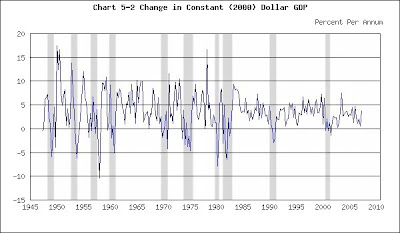

But before you conclude that the New Economy has taken on new life, consider the following. The BLS report states third-quarter GDP’s rapid rise accounts for most of the productivity gain. Update the chart below with GDP’s 4.9% third-quarter jump, and you’ll note an increase that is almost as impressive as productivity’s surge.

GDP

(Click on chart to enlarge)

Recessions shaded

The point is: Productivity tends to fluctuate with output. We had good fortune in the third quarter when output and productivity leapt upward. If GDP growth begins to falter as the economy weakens in the months ahead, expect diminishing productivity gains and rising costs. That will constrain the Fed’s freedom of action and investor’s enthusiasm.

(The charts are taken from http://www.beyourowneconomist.com. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of economic indicators.)

Stocks jumped this morning when the Bureau of Labor Statistics (BLS) announced (http://stats.bls.gov/news.release/prod2.nr0.htm) that third-quarter productivity had surged 6.7%. Use that number to update the chart below in your mind’s eye, and you’ll appreciate the impressive size of this gain. There hasn’t been a jump like that in years.

Productivity

(Click on chart to enlarge)

Recessions shaded

Productivity measures the economy’s efficiency: How much output grows for each additional hour of labor employed. (Think of miles per gallon [MPG] as an analogy. An efficient engine travels further - and less expensively - on a gallon of fuel.) Greater output per hour of work indicates that fewer hours were required to complete a task. Since labor must be paid, rising productivity – and falling labor time per unit of output – implies falling costs. And sure enough, the BLS also reported unit labor costs fell 2.0% in the third quarter.

Investors love reports like these because rising productivity and falling costs signal a reduction in inflationary pressures. That means the Fed is more likely to reduce interest rates at its December 11 meeting. Falling interest rates are good for stocks because stock prices rise when investors desert interest-earning assets (with declining yields) in order to purchase stocks.

But before you conclude that the New Economy has taken on new life, consider the following. The BLS report states third-quarter GDP’s rapid rise accounts for most of the productivity gain. Update the chart below with GDP’s 4.9% third-quarter jump, and you’ll note an increase that is almost as impressive as productivity’s surge.

GDP

(Click on chart to enlarge)

Recessions shaded

The point is: Productivity tends to fluctuate with output. We had good fortune in the third quarter when output and productivity leapt upward. If GDP growth begins to falter as the economy weakens in the months ahead, expect diminishing productivity gains and rising costs. That will constrain the Fed’s freedom of action and investor’s enthusiasm.

(The charts are taken from http://www.beyourowneconomist.com. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of economic indicators.)

Tuesday, December 4, 2007

No Recession Yet

The Lehmann Letter ©

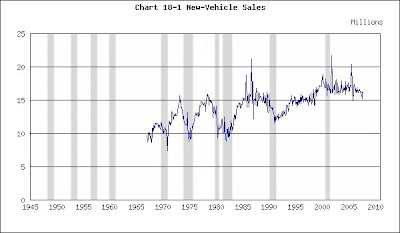

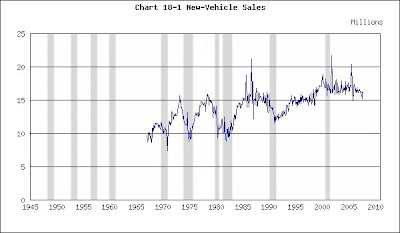

At the beginning of each month The Wall Street Journal publishes an article on the prior month’s auto sales. Today’s story (http://online.wsj.com/article/SB119643941326509603.html?mod=hpp_us_whats_news) carried an interesting quote:

“Auto makers had grown accustomed to industry sales of around 17 million. The industry's overall seasonally adjusted annual selling pace in November was 16.2 million light vehicles, according to Autodata.

“Ford's production cut reflected a "particularly challenging" market environment, said George Pipas, the auto maker's top sales analyst, adding that the nation's economic outlook "contains a high level of uncertainty." Ford expects 2008 total sales to track as low as 15.2 million light vehicles during the first six months of next year, or nearly a million fewer than 2007's expected total, Mr. Pipas said, though he stressed that projection wasn't Ford's finalized full-year forecast.”

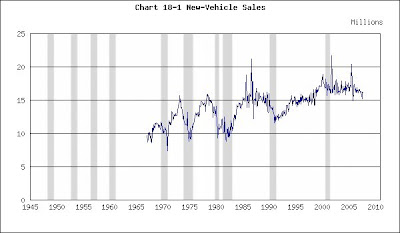

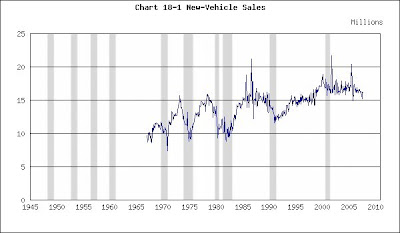

Take a look at the following chart to put this information in perspective.

New-Vehicle Sales

(Click on chart to enlarge)

Recessions shaded

You can see why auto sales are of interest. They led the economy into recession in each slump over the past 40 years except for the last one. In 2001 the auto manufacturers kept sales aloft by slashing customers’ financing costs. Since then auto purchases have been on a remarkable plateau. As the quote above said, “Auto makers had grown accustomed to industry sales of around 17 million.”

The article reports a16.2 million annual selling pace in November and tells us that Ford forecasts a 15.2 million rate in the first half of 2008. That’s not bad, and nowhere near a recessionary slump. If that forecast proves correct, auto sales will not drag the economy into recession’s trough.

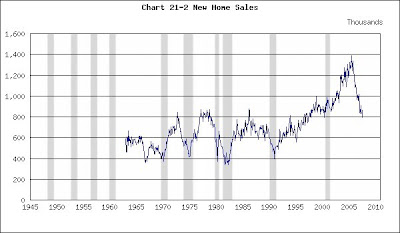

These sales numbers and projections are important because, as earlier editions of this blog have observed, a slump in residential-construction activity has never been enough to instigate recession. In the past surging inflation constricted consumer confidence and reduced construction and auto activity. Housing AND autos led the way into recession, never housing alone.

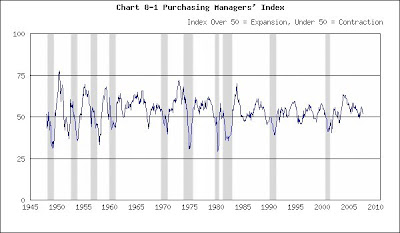

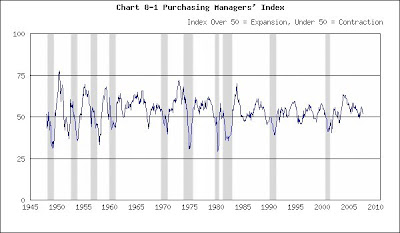

Neither housing nor autos slumped in the 2001 recession. A contraction in business capital expenditures led that decline. That’s why yesterday’s Institute for Supply Management (ISM) report on manufacturing activity (known as the Purchasing Managers’ Index) is important. The ISM disclosed that manufacturing continued to expand at an anemic pace of 50.8. (Anything over 50 signals expansion.)

Purchasing Managers’ Index

(Click on chart to enlarge)

Recessions shaded

The index fell during the 2001 recession and then recovered sharply as manufacturing expanded rapidly. But the rate of expansion has trailed downward over the past few years and is now on the knife’s edge of falling into contraction. It’s tepid, but not yet cold.

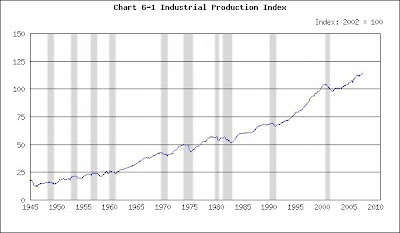

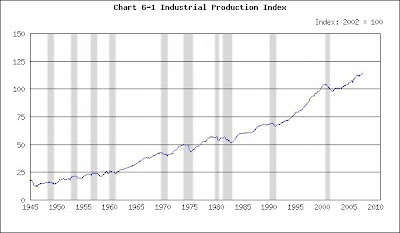

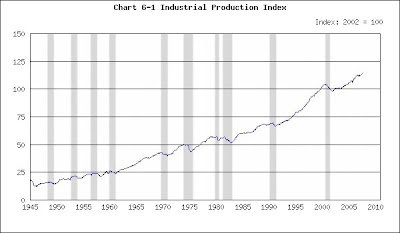

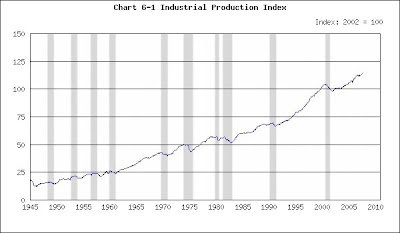

Industrial production’s record confirms this.

Industrial Production

(Click on chart to enlarge)

Recessions shaded

Industrial production stumbled in the 2001 recession when business curtailed its expansionary plans. Then it resumed its upward trend, although not at the torrid pace of the late 1990s. The Federal Reserve releases November’s data in ten days. If it replicates the ISM report, there will be no signal that we’re in recession.

The housing debacle is awful, but that’s a single indicator. And most statistics, such as those discussed above, have not yet slumped. We must wait and see.

(The charts are taken from http://www.beyourowneconomist.com. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of economic indicators.)

At the beginning of each month The Wall Street Journal publishes an article on the prior month’s auto sales. Today’s story (http://online.wsj.com/article/SB119643941326509603.html?mod=hpp_us_whats_news) carried an interesting quote:

“Auto makers had grown accustomed to industry sales of around 17 million. The industry's overall seasonally adjusted annual selling pace in November was 16.2 million light vehicles, according to Autodata.

“Ford's production cut reflected a "particularly challenging" market environment, said George Pipas, the auto maker's top sales analyst, adding that the nation's economic outlook "contains a high level of uncertainty." Ford expects 2008 total sales to track as low as 15.2 million light vehicles during the first six months of next year, or nearly a million fewer than 2007's expected total, Mr. Pipas said, though he stressed that projection wasn't Ford's finalized full-year forecast.”

Take a look at the following chart to put this information in perspective.

New-Vehicle Sales

(Click on chart to enlarge)

Recessions shaded

You can see why auto sales are of interest. They led the economy into recession in each slump over the past 40 years except for the last one. In 2001 the auto manufacturers kept sales aloft by slashing customers’ financing costs. Since then auto purchases have been on a remarkable plateau. As the quote above said, “Auto makers had grown accustomed to industry sales of around 17 million.”

The article reports a16.2 million annual selling pace in November and tells us that Ford forecasts a 15.2 million rate in the first half of 2008. That’s not bad, and nowhere near a recessionary slump. If that forecast proves correct, auto sales will not drag the economy into recession’s trough.

These sales numbers and projections are important because, as earlier editions of this blog have observed, a slump in residential-construction activity has never been enough to instigate recession. In the past surging inflation constricted consumer confidence and reduced construction and auto activity. Housing AND autos led the way into recession, never housing alone.

Neither housing nor autos slumped in the 2001 recession. A contraction in business capital expenditures led that decline. That’s why yesterday’s Institute for Supply Management (ISM) report on manufacturing activity (known as the Purchasing Managers’ Index) is important. The ISM disclosed that manufacturing continued to expand at an anemic pace of 50.8. (Anything over 50 signals expansion.)

Purchasing Managers’ Index

(Click on chart to enlarge)

Recessions shaded

The index fell during the 2001 recession and then recovered sharply as manufacturing expanded rapidly. But the rate of expansion has trailed downward over the past few years and is now on the knife’s edge of falling into contraction. It’s tepid, but not yet cold.

Industrial production’s record confirms this.

Industrial Production

(Click on chart to enlarge)

Recessions shaded

Industrial production stumbled in the 2001 recession when business curtailed its expansionary plans. Then it resumed its upward trend, although not at the torrid pace of the late 1990s. The Federal Reserve releases November’s data in ten days. If it replicates the ISM report, there will be no signal that we’re in recession.

The housing debacle is awful, but that’s a single indicator. And most statistics, such as those discussed above, have not yet slumped. We must wait and see.

(The charts are taken from http://www.beyourowneconomist.com. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of economic indicators.)

Monday, December 3, 2007

December Publication Schedule & Web Sources

The Lehmann Letter ©

Here’s December’s economic-indicator publication schedule, followed by a list of web sources. Future postings will discuss these indicators.

You can use the WEB SOURCES listing to find the data on your own and read the accompanying press release. The addresses take you to the source’s home page and the steps tell you how to navigate the site. That way (rather than provide a direct link to the data) you can become familiar with these sites and find additional information on your own.

(P.S. ISM’s Purchasing Managers’ Index was out today at 50.8 More on that tomorrow,)

PUBLICATION SCHEDULE

December 2007

Source (* below)…………………Series Description…………………Day & Date

Quarterly Data

BLS………………………………….Productivity & costs…………………Wed, 5th

Census……………………………..Manufacturing profits………..……Mon, 10th

BEA…………………………………GDP………………………….….............Thu, 20th

BEA…………………………………Corporate profits……………………..Thu, 20th

BEA……………………………..….International transactions……….Mon, 17th

Monthly Data

ISM…………………………………Purchasing managers’ index…....Mon, 3rd

BLS…………………………………Employment……………………………Fri, 7th

Fed…………………………………Consumer credit………………………Fri, 7th

Census…………………………….Balance of trade………………………Wed, 12th

BLS…………………………………Producer prices………………………Thu, 13th

Census……………………………Retail trade……………………………..Thu, 13th

Census……………………………Inventories……………………………..Thu, 13th

BLS…………………………………Consumer prices……………………..Fri, 14th

Fed…………………………………Industrial production……………...Fri, 14th

Fed…………………………………Capacity utilization………………….Fri, 14th

Census…………………………….Housing starts………………………...Tue, 18th

BEA………………………………..Personal income………………………Fri, 21st

Conf Bd…………………………..Economic Indicators……………….Thu, 20th

Census…………………………...Capital goods…………………………..Thu, 27th

Conf Bd…………………….…….Consumer confidence………………Thu, 27th

Census……………………………New-home sales……………………….Fri, 28th

NAR……………………………….Existing-home sales…………….…..Mon, 31st

* BEA = Bureau of Economic Analysis of the U.S. Department of Commerce

* Census = U.S. Bureau of the Census

* Conf Bd = Conference Board

* Fed = Federal Reserve System

* ISM = Institute for Supply Management

* NAR = National Association of Realtors

WEB SOURCES

Quarterly

Manufacturers’ After-tax Profits

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "PDF" on the left under "Quarterly Financial Report - Manufacturing, Mining and Trade"

Step 3: Scroll down to Table 2 and find after-tax profits for all manufacturing corporation

Labor Productivity & Unit Labor Costs

http://stats.bls.gov

Step 1: Click on “Productivity and Costs” under “Productivity” in left-hand menu bar

Step 2: Click on (HTML) following “Productivity and Costs” under "Economic News Releases:"

Step 3: Click on “Table 1. Business sector"

Step 4: Obtain the most recent quarterly index values for "Output per hour of all persons" and "Unit labor costs" and then scroll down and obtain their "Percent change from previous quarter at annual rate"

Gross Domestic Product

http://www.bea.gov/

Step 1: Click on "Gross Domestic Product" under "National"

Step 2: Click on "National Income and Product Accounts Tables" under "Gross Domestic Product (GDP)"

Step 3: Click on "list of all NIPA Tables"

Step 4: Click on "Table 1.1.6. Real Gross Domestic Product..." and "Table 1.1.1. Percent Change..."

Step 5: Scroll down to line 1 in both tables and go to the last column on the right

After-tax Corporate Profits

http://www.bea.gov/

Step 1: Click on "Gross Domestic Product" under "National"

Step 2: Click on "National Income and Product Accounts Tables" under "Gross Domestic Product (GDP)"

Step 3: Click on "list of all NIPA Tables"

Step 4: Click on "Table 1.12. National Income by Type of Income (A) (Q)"

Step 5: Scroll down to line 46 and go to the last column on the right

International Transactions

http://www.bea.gov

Step 1: Click on "Balance of Payments" under "International"

Step 2: Click on "Detailed estimates"

Step 3: Click on “Table 1. U.S. International Transactions"

Step 4: See lines 72, 74 & 77

Monthly

Institute For Supply Management Index

http://www.ism.ws/

Step 1: Click on "ISM Report on Business" in left-hand menu bar

Step 2: Click on “Latest Manufacturing ROB” and find the latest PMI

Employment Data

(Total Non-farm Payroll Employment)

(Unemployment Rate)

(Manufacturing Workweek)

http://stats.bls.gov/

Step 1: Click on “National Employment” under “Employment & Unemployment” in right-hand menu bar

Step 2: Click on (HTML) following “Employment Situation Summary” under "Economic News Releases"

Step 3: Click on “Employment Situation Summary” under “Table of Contents”

Step 4: Scroll down to Table A and find the unemployment rate for all workers in the latest month, the change in nonfarm employment in the last column and manufacturing hours of work for the latest month

Consumer Credit

http://www.federalreserve.gov/

Step 1: Click on "All Statistical Releases" under "Recent Statistical Releases" and then click on "Consumer credit -- G19" under "Household Finance" in the upper right

Step 2: Click on "Current Release"

Step 3: Go to "Amount ... billions of dollars" and subtract previous month from current month & multiply by 12 to obtain seasonally adjusted dollar amount at annual rate

Balance of Trade

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "PDF" on the left under "U.S. International Trade in Goods and Services"

Producer Prices

http://stats.bls.gov/

Step 1: Click on “Producer Price Indexes” under “Inflation & Consumer Spending” in left-hand menu bar

Step 2: Note "Finished goods" under "Latest Numbers" in upper right and multiply by 12 to put the data on an annual basis

Retail Trade

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Scroll down to "Advance Monthly Sales for Retail and Food Services" and click on "HTML" on the left under "Current Press Release"

Inventories, Sales & Inventory/Sales Ratio

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "HTML" on the left under "Manufacturing and Trade Inventories and Sales"

Step 3: Scroll down to Table 1 and subtract previous month's inventories from latest month's and multiply by 12 to obtain inventory change, and then obtain the most recent inventory/sales ratio

Consumer Price Index

http://stats.bls.gov/

Step 1: Click on “Consumer Price Index” under “Inflation & Consumer Spending” in left-hand menu bar

Step 2: Note "CPI-U..." at the top under "Latest Numbers" in upper right and multiply "SA" by 12 to put the data on an annual basis

Industrial Production & Capacity Utilization

http://www.federalreserve.gov/

Step 1: Click on "All Statistical Releases" under "Recent Statistical Releases" and then click on "Industrial Production and Capacity Utilization" under "Principal Economic Indicators" in the upper left

Step 2: Click on "Current Monthly Release"

Step 3: Find the latest monthly data in the table next to "Total index" and "Total industry"

Housing Starts

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "PDF" on the left under "Current Press Release" under "Housing Starts/Building Permits"

Step 3: Scroll down to "Housing Starts"

Personal Income

http://www.bea.gov/

Step 1: Click on "Gross Domestic Product" under "National"

Step 2: Click on "National Income and Product Accounts Tables" under "Gross Domestic Product (GDP)"

Step 3: Click on "list of all NIPA Tables"

Step 4: Click on "Table 2.6 Personal Income..."

Step 5: Scroll down to line 1

Index of Leading Economic Indicators

http://www.conference-board.org/

Step 1: Click on "Economics" in the left-hand menu bar

Step 2: Click on "Economic Indicators" under "Economics" in the left-hand menu bar

Step 3: Click on link under "U.S. Leading Indicators"

Business Capital Expenditures

(Nondefense Capital Goods)

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "PDF" on the left under "Advance Report on Durable Goods Manufacturers' Shipments and Orders"

Step 3: Scroll down to Table 1 and find new orders for nondefense capital goods near the bottom

Consumer Confidence

http://www.conference-board.org/

Step 1: Click on the "Economics" in the left-hand menu bar

Step 2: Click on "Economic Indicators" under "Economics" in the left-hand menu bar

Step 3: Click on link under "Consumer Confidence Index"

New-Home Sales

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "PDF" on the left under "Current Press Release" under "New Home Sales"

Existing-Home Sales

http://www.realtor.org/

Step 1: Click on "Research" in the left-hand menu bar

Step 2: Find "Existing-Home Sales" under "Housing Indicators"

Here’s December’s economic-indicator publication schedule, followed by a list of web sources. Future postings will discuss these indicators.

You can use the WEB SOURCES listing to find the data on your own and read the accompanying press release. The addresses take you to the source’s home page and the steps tell you how to navigate the site. That way (rather than provide a direct link to the data) you can become familiar with these sites and find additional information on your own.

(P.S. ISM’s Purchasing Managers’ Index was out today at 50.8 More on that tomorrow,)

PUBLICATION SCHEDULE

December 2007

Source (* below)…………………Series Description…………………Day & Date

Quarterly Data

BLS………………………………….Productivity & costs…………………Wed, 5th

Census……………………………..Manufacturing profits………..……Mon, 10th

BEA…………………………………GDP………………………….….............Thu, 20th

BEA…………………………………Corporate profits……………………..Thu, 20th

BEA……………………………..….International transactions……….Mon, 17th

Monthly Data

ISM…………………………………Purchasing managers’ index…....Mon, 3rd

BLS…………………………………Employment……………………………Fri, 7th

Fed…………………………………Consumer credit………………………Fri, 7th

Census…………………………….Balance of trade………………………Wed, 12th

BLS…………………………………Producer prices………………………Thu, 13th

Census……………………………Retail trade……………………………..Thu, 13th

Census……………………………Inventories……………………………..Thu, 13th

BLS…………………………………Consumer prices……………………..Fri, 14th

Fed…………………………………Industrial production……………...Fri, 14th

Fed…………………………………Capacity utilization………………….Fri, 14th

Census…………………………….Housing starts………………………...Tue, 18th

BEA………………………………..Personal income………………………Fri, 21st

Conf Bd…………………………..Economic Indicators……………….Thu, 20th

Census…………………………...Capital goods…………………………..Thu, 27th

Conf Bd…………………….…….Consumer confidence………………Thu, 27th

Census……………………………New-home sales……………………….Fri, 28th

NAR……………………………….Existing-home sales…………….…..Mon, 31st

* BEA = Bureau of Economic Analysis of the U.S. Department of Commerce

* Census = U.S. Bureau of the Census

* Conf Bd = Conference Board

* Fed = Federal Reserve System

* ISM = Institute for Supply Management

* NAR = National Association of Realtors

WEB SOURCES

Quarterly

Manufacturers’ After-tax Profits

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "PDF" on the left under "Quarterly Financial Report - Manufacturing, Mining and Trade"

Step 3: Scroll down to Table 2 and find after-tax profits for all manufacturing corporation

Labor Productivity & Unit Labor Costs

http://stats.bls.gov

Step 1: Click on “Productivity and Costs” under “Productivity” in left-hand menu bar

Step 2: Click on (HTML) following “Productivity and Costs” under "Economic News Releases:"

Step 3: Click on “Table 1. Business sector"

Step 4: Obtain the most recent quarterly index values for "Output per hour of all persons" and "Unit labor costs" and then scroll down and obtain their "Percent change from previous quarter at annual rate"

Gross Domestic Product

http://www.bea.gov/

Step 1: Click on "Gross Domestic Product" under "National"

Step 2: Click on "National Income and Product Accounts Tables" under "Gross Domestic Product (GDP)"

Step 3: Click on "list of all NIPA Tables"

Step 4: Click on "Table 1.1.6. Real Gross Domestic Product..." and "Table 1.1.1. Percent Change..."

Step 5: Scroll down to line 1 in both tables and go to the last column on the right

After-tax Corporate Profits

http://www.bea.gov/

Step 1: Click on "Gross Domestic Product" under "National"

Step 2: Click on "National Income and Product Accounts Tables" under "Gross Domestic Product (GDP)"

Step 3: Click on "list of all NIPA Tables"

Step 4: Click on "Table 1.12. National Income by Type of Income (A) (Q)"

Step 5: Scroll down to line 46 and go to the last column on the right

International Transactions

http://www.bea.gov

Step 1: Click on "Balance of Payments" under "International"

Step 2: Click on "Detailed estimates"

Step 3: Click on “Table 1. U.S. International Transactions"

Step 4: See lines 72, 74 & 77

Monthly

Institute For Supply Management Index

http://www.ism.ws/

Step 1: Click on "ISM Report on Business" in left-hand menu bar

Step 2: Click on “Latest Manufacturing ROB” and find the latest PMI

Employment Data

(Total Non-farm Payroll Employment)

(Unemployment Rate)

(Manufacturing Workweek)

http://stats.bls.gov/

Step 1: Click on “National Employment” under “Employment & Unemployment” in right-hand menu bar

Step 2: Click on (HTML) following “Employment Situation Summary” under "Economic News Releases"

Step 3: Click on “Employment Situation Summary” under “Table of Contents”

Step 4: Scroll down to Table A and find the unemployment rate for all workers in the latest month, the change in nonfarm employment in the last column and manufacturing hours of work for the latest month

Consumer Credit

http://www.federalreserve.gov/

Step 1: Click on "All Statistical Releases" under "Recent Statistical Releases" and then click on "Consumer credit -- G19" under "Household Finance" in the upper right

Step 2: Click on "Current Release"

Step 3: Go to "Amount ... billions of dollars" and subtract previous month from current month & multiply by 12 to obtain seasonally adjusted dollar amount at annual rate

Balance of Trade

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "PDF" on the left under "U.S. International Trade in Goods and Services"

Producer Prices

http://stats.bls.gov/

Step 1: Click on “Producer Price Indexes” under “Inflation & Consumer Spending” in left-hand menu bar

Step 2: Note "Finished goods" under "Latest Numbers" in upper right and multiply by 12 to put the data on an annual basis

Retail Trade

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Scroll down to "Advance Monthly Sales for Retail and Food Services" and click on "HTML" on the left under "Current Press Release"

Inventories, Sales & Inventory/Sales Ratio

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "HTML" on the left under "Manufacturing and Trade Inventories and Sales"

Step 3: Scroll down to Table 1 and subtract previous month's inventories from latest month's and multiply by 12 to obtain inventory change, and then obtain the most recent inventory/sales ratio

Consumer Price Index

http://stats.bls.gov/

Step 1: Click on “Consumer Price Index” under “Inflation & Consumer Spending” in left-hand menu bar

Step 2: Note "CPI-U..." at the top under "Latest Numbers" in upper right and multiply "SA" by 12 to put the data on an annual basis

Industrial Production & Capacity Utilization

http://www.federalreserve.gov/

Step 1: Click on "All Statistical Releases" under "Recent Statistical Releases" and then click on "Industrial Production and Capacity Utilization" under "Principal Economic Indicators" in the upper left

Step 2: Click on "Current Monthly Release"

Step 3: Find the latest monthly data in the table next to "Total index" and "Total industry"

Housing Starts

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "PDF" on the left under "Current Press Release" under "Housing Starts/Building Permits"

Step 3: Scroll down to "Housing Starts"

Personal Income

http://www.bea.gov/

Step 1: Click on "Gross Domestic Product" under "National"

Step 2: Click on "National Income and Product Accounts Tables" under "Gross Domestic Product (GDP)"

Step 3: Click on "list of all NIPA Tables"

Step 4: Click on "Table 2.6 Personal Income..."

Step 5: Scroll down to line 1

Index of Leading Economic Indicators

http://www.conference-board.org/

Step 1: Click on "Economics" in the left-hand menu bar

Step 2: Click on "Economic Indicators" under "Economics" in the left-hand menu bar

Step 3: Click on link under "U.S. Leading Indicators"

Business Capital Expenditures

(Nondefense Capital Goods)

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "PDF" on the left under "Advance Report on Durable Goods Manufacturers' Shipments and Orders"

Step 3: Scroll down to Table 1 and find new orders for nondefense capital goods near the bottom

Consumer Confidence

http://www.conference-board.org/

Step 1: Click on the "Economics" in the left-hand menu bar

Step 2: Click on "Economic Indicators" under "Economics" in the left-hand menu bar

Step 3: Click on link under "Consumer Confidence Index"

New-Home Sales

http://www.census.gov/

Step 1: Click on "Economic Indicators" in the lower right

Step 2: Click on "PDF" on the left under "Current Press Release" under "New Home Sales"

Existing-Home Sales

http://www.realtor.org/

Step 1: Click on "Research" in the left-hand menu bar

Step 2: Find "Existing-Home Sales" under "Housing Indicators"

Thursday, November 29, 2007

Bad-News Good-News Joke

The Lehmann Letter ©

This week’s developments have been a good-news bad-news joke in reverse. The bad news hits, and then the stock market rises.

Yesterday Fed Vice Chairman Donald Kohn, in a speech before the Council on Foreign Relations (http://www.federalreserve.gov/newsevents/speech/kohn20071128a.htm), said:

“To be sure, lowering interest rates to keep the economy on an even keel when adverse financial market developments occur will reduce the penalty incurred by some people who exercised poor judgment. But these people are still bearing the costs of their decisions and we should not hold the economy hostage to teach a small segment of the population a lesson.”