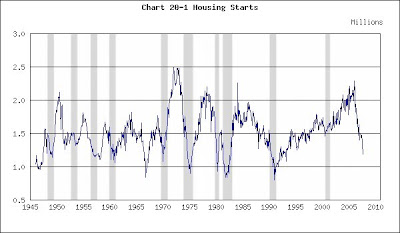

This morning’s Census Bureau report (http://www.census.gov/const/newresconst.pdf) about housing start’s October improvement is good news. Starts had been 1.193 million in September and edged up to 1.229 million. That’s only a 3% gain, but does interrupt a downward slide. The following chart presents the trend.

Housing Starts

(Click on chart to enlarge)

Recessions shaded

Housing starts have fallen by about one million from their 2005 peak. Every slide of this magnitude since WWII has led to recession. The economy may dodge the bullet this time because there’s been no accompanying auto-sales slump. (The November 13 posting observed that housing and autos plunged together prior to earlier recessions.) It remains to be seen whether or not home-refinancing difficulties curtail auto sales.

The chart also makes clear that trends are interrupted by monthly wiggles in the data. We’ll see whether or not October’s rebound is a good omen or a false ray of hope.

But there’s a more-troubling fact behind the housing-starts number. The 1.229 million figure reported in the first paragraph includes apartment-house construction, and apartment construction has avoided the slump and even turned up lately. Single-family construction, on the other hand, fell from 954,000 in September to 884,000 in October. That’s a significant 7% decline. It shows that the fall in single-family activity (the eye of the storm) continues unabated.

The following charts present single-family activity and all confirm the trouble in that market.

Existing-Home Sales

(Click on chart to enlarge)

Recessions shaded

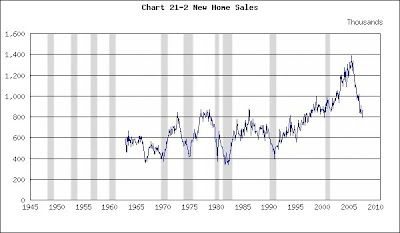

New-Home Sales

(Click on chart to enlarge)

Recessions shaded

Home sales are down and continue to fall. Why should builders start constructing new homes when there’s such difficulty moving the existing ones?

(The charts are copied from http://www.beyourowneconomist.com. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of economic indicators.)

No comments:

Post a Comment