While this blog remained preoccupied with the December 7 employment report and the December 11 Federal Reserve rate cut, two other statistics were released to little notice. They should have received more attention because they could be bad omens for consumer demand and corporate profits.

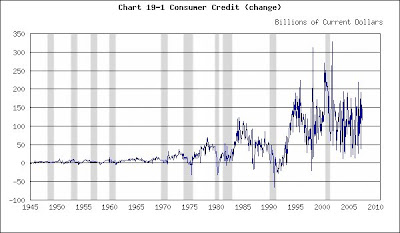

On December 7 the Fed reported (http://www.federalreserve.gov/releases/g19/Current/) that consumer credit grew $4.7 billion in October. (You can obtain this figure from the press release by subtracting September’s outstanding debt - seasonally adjusted – from October’s.) Multiply that number by 12 to put the data on an annual basis. Now compare that $56.4 billion product in your mind’s eye with the series in the chart below.

Consumer Credit

(Click on chart to enlarge)

Recessions shaded

Consumer credit is the kind of borrowing we resort to when we “buy on time.” It typically finances consumer-durables expenditures such as automobile purchases. It does not include real-estate mortgage debt, financing or refinancing of any kind.

There’s plenty of noise in the data. The line wobbles like the Richter Scale during a California earthquake. Yet your mind’s eye can see that consumer credit has been growing by $100 billion per month at an annual rate for the past half decade. October’s $56.4 billion is a downward break from that trend, and September’s $38.4 billion was even more anemic. Does the apparent shrinkage signal consumers’ future reluctance to buy? Stay tuned.

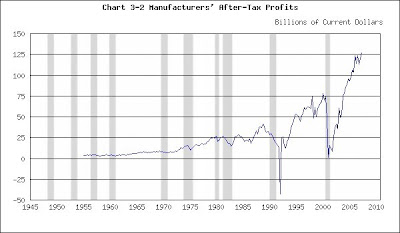

On December 10 the Census Bureau reported (http://www.census.gov/csd/qfr/view/qfr_mg.pdf) that manufacturers’ after-tax profits fell to $87.563 billion in the third quarter. Update the chart below in your mind’s eye and you can see the substantial drop in earnings. Profits had been in the $120 billion range through the second quarter. Unlike the consumer credit statistic, this series does not have a lot of noise. A $35 billion plunge is probably a noteworthy event, not a random hiccup in the data.

Manufacturing After-Tax profits

(Click on chart to enlarge)

Recessions shaded

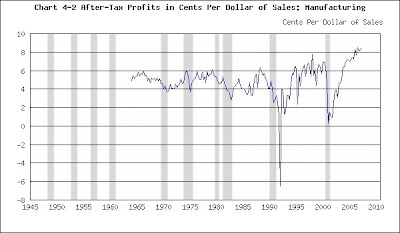

At the same time the Census Bureau also reported that manufacturing profit margins fell to 5.67 cents per dollar of sales from over 8 cents in the second quarter. This decline in margins probably generated the overall drop in profits noted above. Strong competitive pressures may have prevented management from raising prices sufficiently to recoup increased costs.

Update the chart below in your mind’s eye. This chart does not have a lot of noise either. A 2-cent decline in margins is a noteworthy event.

Manufacturing Profit Margins in Cents Per Dollar of Sales

(Click on chart to enlarge)

Recessions shaded

Declining profits and profitability (margins) are bad omens for the economy. Together with the deterioration in consumer credit………… Let’s just say they’re cause for concern.

(The charts were taken from http://www.beyourowneconomist.com. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of Economic Indicators.)

© 2007 Michael B. Lehmann

No comments:

Post a Comment