The Federal Reserve reduced the federal-funds rate by a quarter-of-a-point today. You can find the Fed’s announcement at http://www.federalreserve.gov/newsevents/press/monetary/20071211a.htm.

The text follows:

“The Federal Open Market Committee decided today to lower its target for the federal funds rate 25 basis points to 4-1/4 percent.

“Incoming information suggests that economic growth is slowing, reflecting the intensification of the housing correction and some softening in business and consumer spending. Moreover, strains in financial markets have increased in recent weeks. Today’s action, combined with the policy actions taken earlier, should help promote moderate growth over time.

“Readings on core inflation have improved modestly this year, but elevated energy and commodity prices, among other factors, may put upward pressure on inflation. In this context, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

“Recent developments, including the deterioration in financial market conditions, have increased the uncertainty surrounding the outlook for economic growth and inflation. The Committee will continue to assess the effects of financial and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

“Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Charles L. Evans; Thomas M. Hoenig; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; William Poole; and Kevin M. Warsh. Voting against was Eric S. Rosengren, who preferred to lower the target for the federal funds rate by 50 basis points at this meeting.

“In a related action, the Board of Governors unanimously approved a 25-basis-point decrease in the discount rate to 4-3/4 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, and St. Louis.”

The news disappointed the stock market. The S&P fell 38 points and the Dow was down 294 at the close. That’s not surprising. The stock market likes falling interest rates, and most investors obviously preferred a deeper cut. Falling interest rates – on investments that are an alternative to stocks - improve stocks’ attractiveness. Other stock sellers may believe that the Fed’s actions reveal the Fed’s failure to appreciate the likelihood of recession. Those sellers bailed out because they fear the Fed will fail to take sufficient corrective action – in the form of interest-rate reductions – to prevent recession.

But that begs the question of whether or not falling interest rates can prevent recession. Here are the issues.

Economists traditionally prescribed an expansionary monetary policy to counteract economic sluggishness. All things being equal, as the economists like to say, business firms invest more in plant, equipment and inventory when interest rates fall. Lower rates facilitate the borrowing that finances capital expenditures, and lower rates encourage business to invest its own funds in capital expansion rather than purchase an interest-earning instrument.

That logic extended to household capital expenditures because lower mortgage rates encouraged residential construction, and rising rates discouraged building. That was especially evident in the 1960s, 1970s and 1980s. Rapid economic expansion in those decades periodically generated inflation and (with the Fed’s encouragement) rising interest rates. Residential construction slumped when rates rose, and did not bounce back until falling inflation and (with the Fed’s connivance) falling interest rates encouraged construction’s recovery. To sum up: Rates down = construction up = economic recovery.

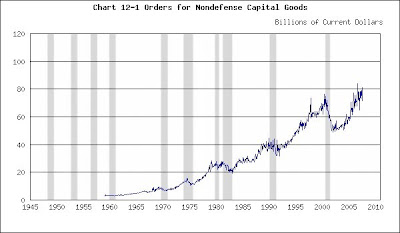

The 2001 recession provides an interesting illustration. Business capital expenditures slumped dramatically, as the chart below illustrates.

Nondefense Capital Goods

(Click on chart to enlarge)

Recessions shaded

Nondefense capital expenditures (everything from Boeings to backhoes) tumbled because of the 2001 dot.com bust. The Fed rode to the rescue, as the next chart shows.

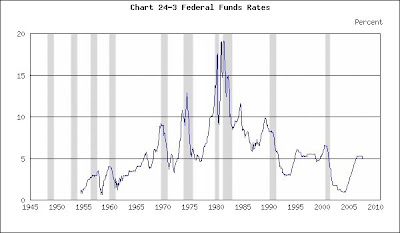

Federal Funds Rate

(Click on chart to enlarge)

Recessions shaded

The Fed sharply reduced the federal-funds rate in 2001, and you can see that nondefense capital goods began to recover. But the rate cut probably had little to do with that capital-expenditure rebound. Technology had its own imperatives that loomed larger than prevailing interest rates.

Housing Starts

(Click on chart to enlarge)

Recessions shaded

Housing starts are another matter. No one doubts that falling mortgage rates kindled the 2001 – 2005 construction boom. It was a traditional example of the salutary effect of a Fed rate cut upon housing activity. To sum up (once again): Rates down = construction up = economic recovery.

But something unusual happened next. The economy soared, yet there was no inflation. Instead a speculative bubble emerged in the housing market. Then the air began to leak from the bubble and the great housing implosion began. It was an old-fashioned sell-off, akin to the 2000 – 2002 stock-market panic. Real-estate prices fell in an atmosphere of low inflation. The decline bore little similarity to the (inflation-driven, rising interest rate) housing slumps of old.

So the question arises, “If this housing bust is unlike the housing downturns of the past, can the Fed’s traditional rate-cut policy spur recovery?”

We’ll wait and see, but the probable answer is: “Not likely. If rising inflation and rising interest rates didn’t cause the slump, how effectively can falling rates generate recovery?”

(The charts were taken from http://www.beyourowneconomist.com. [Click on Seminars and then Charts.] Go there for additional charts on the economy and a list of Economic Indicators.)

© 2007 Michael B. Lehmann

No comments:

Post a Comment